Betfair co-founder Edward Wray and Le Peigne to slash stakes in firm by selling £250 million worth of shares

Edward Wray, who co-founded Betfair Group Ltd (LON:BET) in 2000 alongside gambling entrepreneur Andrew Black in 200o, is set to sell 2.75 million units of common stock in the company, worth approximately £92.5 million as the first major transaction made by Mr. Wray since the company’s £6 billion agreement to merge with bookmaker Paddy Power last month. […]

Edward Wray, who co-founded Betfair Group Ltd (LON:BET) in 2000 alongside gambling entrepreneur Andrew Black in 200o, is set to sell 2.75 million units of common stock in the company, worth approximately £92.5 million as the first major transaction made by Mr. Wray since the company’s £6 billion agreement to merge with bookmaker Paddy Power last month.

Mr. Wray’s substantial liquidation of shares in the company will reduce his stake down considerably from the 9.5% (8.9 million shares) that he currently holds, leaving him and his immediate family with approximately 6.1 million shares after the transaction.

Additionally, Le Peigne SA, the French wealth management firm which looks after the investment portfolio of France’s wealthiest man Bernard Arnault will take its stake in Betfair down by 50% by selling 4.6 million shares at a value of £154 million, thus resulting in a total liquidation of approximately £250 million worth of stock between the two major shareholders.

Betfair’s proposed merger with Paddy Power demonstrates clearly how profitable and lucrative the gambling industry is, especially in the United Kingdom where it is not only legal and where high streets in every town, city and suburb are home to a proliferation of retail bookmaking outlets operated by, among others, Paddy Power, but is also part of British culture.

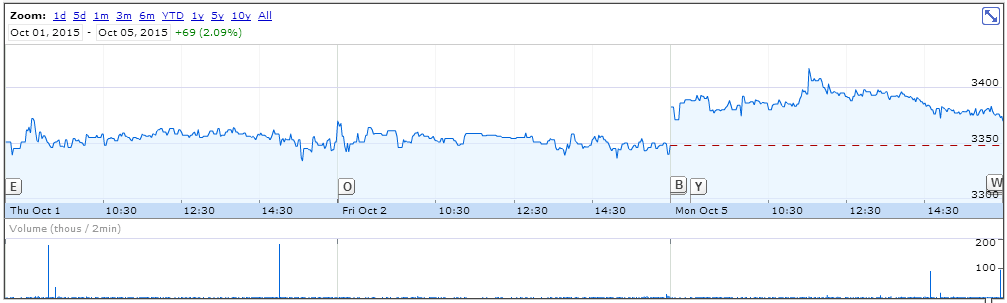

The £6 billion merger has sparked such dramatic investor interest and confidence that shares in Betfair have increased in value exponentially since the announcement last month.

Currently, Betfair is the largest internet gambling exchange in the world, and has been the parent company of innovators such as London’s unique multilateral trading facility (MTF) for FX, LMAX Exchange, which is notable for its no last look execution and leading edge technology.

Founded in 2007 as an evolution of the Betfair retail client/toretail client model, the firm had a difficult inception period, received an investment from Goldman Sachs in 2010, and was relaunched in 2011. In late 2012, LMAX was the subject of a management buyout under the leadership of incumbent CEO David Mercer who joined the firm in April 2011 to turn the company’s fortunes around.

As 2012 drew to a close, LMAX Exchange was sold to members of its management team by Betfair for £2.4 million under a deal which was ratified by the Financial Services Authority (now the FCA) in mid-January, which resulted in Betfair retaining a 33% stake in the company.\

Betfair’s success has not been without a gung-ho approach to administering its stock and dividends. In its 2014 annual report, the company admitted that it had paid its final dividend of 2011, as well as the interim dividends of 2012 and 2013 erroneously, as according to the law the company

“company did not have sufficient distributable reserves to make those distributions and so they should not have been paid by the company to its shareholders”. Betfair also admitted that the purchase of 6.5 million shares in April 2012 was executed when the “company did not have sufficient distributable reserves”.

The imminent sale of shares by Mr. Wray and Le Peigne SA is purely portfolio management on their behalf. Mr. Wray told the Telegraph

“I was not looking to sell. It’s really portfolio management for me, most of my net worth is tied up in Betfair.”

According to that report, British financial institution Barclays approached Mr. Wray last week and informed him that it had a UK institutional investor that was “keen” to buy Betfair stock.

Betfair stock price chart courtesy of Google Finance