Bitcoin breaks all records with a massive $1.347 billion transaction

This transaction has surpassed previous records, setting a new benchmark for Bitcoin trades. Before this event, the largest Bitcoin transactions included a $1.1 billion trade in April 2020 involving 161,500 BTC, and other significant transactions ranging from $491 million to $1.033 billion throughout 2019 and 2020.

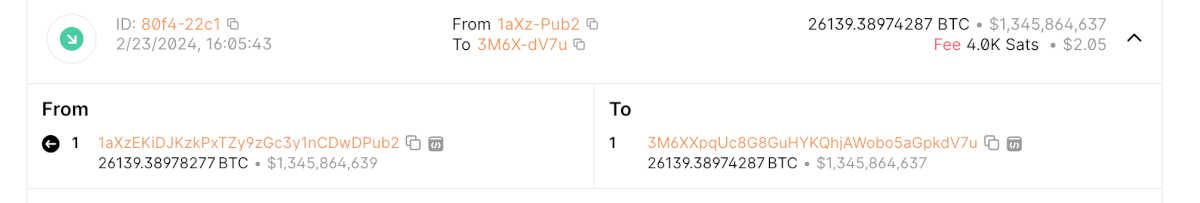

On February 23, 2024, at 16:05:43, the largest Bitcoin transaction in history was executed. The transaction involved the transfer of 26,139.38974287 BTC, valued at approximately $1.347 billion at the time of the transaction.

This monumental trade was conducted between two digital wallets, identified by their addresses as “1aXzEKiDJKzkPxTZy9zGc3y1nCDwDPub2” and “3M6XXpqUc8G8GuHYKQhjAWobo5aGpkdV7u.”

UP NEXT: Should the largest Bitcoin trade be priced in BTC or USD?

The commission for this trade was notably low, at 4.0K Sats (Satoshis), equivalent to $2.06, which goes to show how efficient and cost-effective large-scale transactions within the Bitcoin network have become.

The trade of just a little over 26,000 BTC, valued around $1.347 billion, has surpassed previous records, setting a new benchmark for Bitcoin trades.

Before this event, the largest Bitcoin transaction was a 161,500 BTC trade in April 2020, valued at approximately $1.1 billion, which involved two Bitfinex addresses, later confirmed by CTO Paolo Ardoino. Prior to that, other significant transactions ranged from $491 million to $1.033 billion throughout 2019 and 2020.

These historical transactions highlight the growing scale and value of Bitcoin trades over the years, reflecting the increasing acceptance and integration of cryptocurrencies into the financial landscape.

Who owns this mysterious address?

The address “1aXzEKiDJKzkPxTZy9zGc3y1nCDwDPub2,” associated with the record-breaking Bitcoin transaction, presents an intriguing narrative within the cryptocurrency landscape. Despite its recent entry into the annals of Bitcoin history through a transaction of unparalleled magnitude, this address has engaged in a remarkably low number of transactions on the Bitcoin blockchain, totaling just five before this monumental event. These transactions have resulted in the address receiving an astonishing sum of 26,215.39974287 BTC, equivalent to approximately $1.350 billion. Contrasting with its significant incoming value, the address has sent out a mere 0.01000000 BTC, valued at around $515.34.

This restrained transaction activity coupled with the colossal amount of Bitcoin held introduces a veil of mystery surrounding the owner’s identity and intentions. The sparse transaction history, characterized by receiving a vast quantity of Bitcoin while barely distributing any, raises questions about the strategic objectives behind accumulating such wealth in cryptocurrency.

UP NEXT: Should the largest Bitcoin trade be priced in BTC or USD?

The secrecy surrounding the owner further amplifies the intrigue. In the decentralized and anonymous nature of blockchain, where transactions are transparent but identities are obscured, the actions of this address capture the imagination.

Who owns this address? Is it an individual investor, a collective, or an institution operating behind a veil of blockchain anonymity? The careful curation of transactions, the significant value amassed, and the strategic silence in the blockchain space leave room for endless speculation about the proprietor’s identity and their future moves in the cryptocurrency market.

Should the largest Bitcoin trade be priced in BTC or USD?

In a separate article, we discuss the issue of ranking the largest Bitcoin trade based on their USD value instead of being simply based on the amount of BTC transacted.

For example, the 26,139 BTC trade worth $1.347 billion contrasts sharply with a notable event from 2011, where 500,000 BTC were moved, then valued at around $1.13 million.

While the 2011 transaction boasts a higher volume of Bitcoin, the recent transfer’s fiat valuation far exceeds that of any previous transaction. Read more about it here.