Should the largest Bitcoin trade be priced in BTC or USD?

Three days ago, the Bitcoin network witnessed a staggering transaction of 26,139 BTC, valued at $1.347 billion. This recent transaction contrasts sharply with a notable event from 2011, where 500,000 BTC were moved, then valued at around $1.13 million.

Three days ago, the Bitcoin network witnessed a staggering transaction of 26,139 BTC, valued at $1.347 billion. This monumental transaction has reignited discussions within the cryptocurrency community and beyond about the largest trades in Bitcoin’s history.

Traditionally, the magnitude of a Bitcoin transaction could be assessed in two ways: the volume of Bitcoin transferred or its equivalent value in fiat currency at the time of the transaction.

500,000 BTC worth $1 million vs 26,000 BTC worth $1.3 billion

The 26,139 BTC trade worth $1.347 billion contrasts sharply with a notable event from 2011, where 500,000 BTC were moved, then valued at around $1.13 million. While the 2011 transaction boasts a higher volume of Bitcoin, the recent transfer’s fiat valuation far exceeds that of any previous transaction.

This leads to a broader question: Should Bitcoin continue to be valued in USD, or are we witnessing a turning point in the history of currency?

The debate is fueled further by influential figures like Edward Snowden, who recently proclaimed Bitcoin to be the “most significant monetary advance since the creation of coinage.” It is also widely known that El Salvador made Bitcoin legal tender. Such endorsements bring significant attention to Bitcoin’s potential role in the future of financial systems.

Commodities are priced in currency

Despite the excitement and speculative future uses of Bitcoin, the conclusion drawn from current trends and economic practices is clear: we are not at a turning point towards abandoning traditional fiat currencies in favor of cryptocurrencies like Bitcoin.

The world continues to operate predominantly with fiat currencies such as the USD, EUR, JPY, CHF, and GBP. Bitcoin has indeed carved out a niche for itself, often likened to “digital gold”. However, at this juncture, Bitcoin is not a currency in the conventional sense. Instead, it is widely treated as a commodity by regulators, investors, and miners. Commodities are priced in currencies.

Despite the significant milestones and the disruptive potential of cryptocurrencies, the global financial ecosystem remains firmly anchored in the use of fiat currencies. The journey of Bitcoin and other digital currencies is far from over, but their role as mainstream currency substitutes remains speculative, at least for now.

The issue of ranking the largest Bitcoin trades based on their USD value, rather than merely on the amount of BTC transacted, is pertinent for several reasons:

Market Value Representation: The USD value of a Bitcoin trade more accurately represents its market impact. Given Bitcoin’s price volatility, a trade involving a high amount of BTC might not necessarily command a significant market value at all times. Ranking trades based on USD value provides a clearer picture of the trade’s significance in terms of market liquidity and capital movement.

Comparability: USD valuation offers a standard measure for comparison across different time periods and market conditions. Since the value of BTC can fluctuate widely, comparing the size of trades in BTC terms alone can be misleading. Using USD value allows for a more consistent comparison of trade sizes, facilitating trend analysis and market research.

Investor Relevance: For investors, especially those from traditional finance backgrounds, the USD value of trades is a more familiar and relevant metric. It helps them assess the market’s size, risk, and opportunities in terms they understand, aiding in investment decision-making processes.

Regulatory and Taxation Considerations: Regulatory reporting and taxation often require valuations in fiat currency. Understanding the USD value of trades can thus be essential for compliance purposes, as well as for the financial planning of individuals and institutions participating in the market.

The largest Bitcoin transaction in history was three days ago

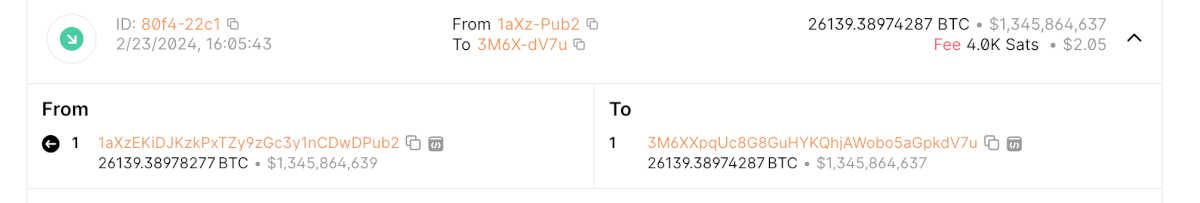

On February 23, 2024, at 16:05:43, the largest Bitcoin transaction in history was executed. The transaction involved the transfer of 26,139.38974287 BTC, valued at approximately $1.347 billion at the time of the transaction.

This monumental trade was conducted between two digital wallets, identified by their addresses as “1aXzEKiDJKzkPxTZy9zGc3y1nCDwDPub2” and “3M6XXpqUc8G8GuHYKQhjAWobo5aGpkdV7u.”

The commission for this trade was notably low, at 4.0K Sats (Satoshis), equivalent to $2.06, which goes to show how efficient and cost-effective large-scale transactions within the Bitcoin network have become. The trade of just a little over 26,000 BTC, valued around $1.347 billion, has surpassed previous records, setting a new benchmark for Bitcoin trades.

Before this event, the largest Bitcoin transaction was a 161,500 BTC trade in April 2020, valued at approximately $1.1 billion, which involved two Bitfinex addresses, later confirmed by CTO Paolo Ardoino. Prior to that, other significant transactions ranged from $491 million to $1.033 billion throughout 2019 and 2020.