Bitcoin dominates inflows into crypto funds, AuM hits $28B

As the price of bitcoin continues to consolidate around recent highs, investors expand their positions in funds designed to profit from further appreciation in the cryptocurrency.

Total assets under management (AuM) have risen to $28 billion, up 43% from their November 2022 lows, crypto investment firm CoinShares said in a new report.

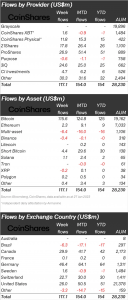

Last week, digital asset investment products saw inflows totaling $117 million, the largest since July 2022, with institutional investors from Germany accounting for nearly half of the new investments in the crypto market.

Among all digital assets, Bitcoin led the inflow tally with a 99 percent share of total investment. Out of that amount, inflows into Bitcoin stood at $116 million while its AuM rose $19.6 billion. The uptick in the bitcoin long positions is usually a bullish sign and might be suggesting negative sentiment is close to its peak.

Despite additions to Bitcoin-based products, short bitcoin funds saw inflows of nearly $4.4 million. AuM on short-Bitcoin is now at $138 million, way below the record high of $186 million.

Breaking down the latest statistics, Coinshares said the aggregate data masks a significant regional polarization of views. In particular, Germany was the focus this week seeing 40% of all inflows ($46 million), followed by Canada, the US and Switzerland which saw $30 million, $26 million and $23 million respectively.

Apart from Bitcoin, Ethereum-based crypto investment products saw minor outflows totaling $2.3 million. That compares to December’s metrics which saw the largest inflows on record into short-Ethereum investment products of $14 million. This negative sentiment was a result of renewed uncertainty over the Shanghai update, which will allow the withdrawal of staking assets, and the hacked FTX ETH assets which sum to ~$280 million.

Meanwhile, multi-asset investment products saw outflows for the 9th consecutive week totaling $6.4 million, suggesting investors are preferring select investments. This was evident in altcoins as Solana, Cardano and Polygon all saw inflows, while Bitcoin Cash, Stellar and Uniswap all saw minor outflows.

Blockchain equities saw inflows of more than $2.4 million, although looking across providers reveals sentiment remains polarised.

CoinShares is Europe’s largest digital asset investment firm. The company has recently changed the trading venue for the company’s shares from Nasdaq First North Growth Market to Nasdaq Stockholm’s main market.

CoinShares said the move provides investors with new ways to gain exposure to the digital asset class. The approval was conditional upon customary conditions being fulfilled, including liquidity requirements and registration with the Swedish Financial Supervisory Authority.