Was it “Black Swan” for FXCM? “Then I sent to Drew to raise margins and he said no”

New evidence indicates that FXCM was well aware of the risks ahead of the January 15, 2015 Swiss franc events and used the “Black Swan” and “Flash crash” labels as cover-up.

“This is most worried I’ve ever heard Eddie or Drew”, “Everyone here looks done”, “They didn’t think it was that bad”, “You take care of your sales; the risk is being managed by the Dealing Department, which you’re not a part of” – these are only examples of the statements in newly uncovered evidence related to the situation preceding and following the January 15, 2015 events at FXCM.

The evidence is included in a recently revived legal case against FXCM Inc, now known as Global Brokerage Inc (NASDAQ:GLBR), and Drew Niv. The case is brought by the Retirement Board of the Policemen’s Annuity and Benefit Fund of Chicago – this is a securities fraud class action brought on behalf of all purchasers of FXCM common stock between March 17, 2014 and January 20, 2015. During the Class Period, Plaintiff and the Class purchased FXCM securities at allegedly artificially inflated prices. When FXCM’s and Niv’s alleged misrepresentations were revealed and the information once concealed from the market was unravelled, the price of FXCM’s securities significantly declined, causing investors’ losses. The Defendants’ conduct is said to have caused an economic loss to the Plaintiff and the Class.

The amended complaint, seen by FinanceFeeds, was filed with the Court on August 25, 2017, accompanied by a raft of Exhibits, containing testimony with the regulators, internal FXCM emails and chats. According to the complaint, the new evidence has emerged as a part of the recent regulatory investigations into FXCM which led to the settlements with the US Commodity Futures Trading Commission (CFTC) and the National Futures Association on February 6, 2017.

In short, the newly discovered evidence questions the “Defendants’ repeated assertions to this Court that the Company’s losses following the SNB’s removal of the cap were the result of an historic “Black Swan” event that Defendants could not have foreseen, and for which they should not be blamed.” The plaintiffs allege that FXCM and its executives were aware of the risk the company and the customers faced due to an eventual SNB action to remove the EUR/CHF peg. The “Black Swan” label was just a… label.

One new piece of evidence is the Deposition testimony of FXCM’s Director of Compliance, Janelle Lester, directly contradicting Defendants’ assertions that FXCM sustained losses from the SNB event because “liquidity dried up.” Ms. Lester testified before the CFTC that FXCM “never had [its] pricing halted by [its] liquidity providers nor did prime brokers stop trading with [FXCM]” on January 15, 2015.

Furthermore, testimony of a number of confidential witnesses (CW) has made apparent numerous warnings made to FXCM’s top management with regard to the increased risk of losses due to CHF trades. The testimony of CW1, formerly employed as FXCM Managing Director in Germany from the start of the Class Period through December 2014, is pretty elucidating.

The witness explained that following Gain’s and Saxo’s announcements in September 2014 about leverage reduction on CHF pairs, there was a significant and almost immediate influx to FXCM of retail customers that had previously traded through the Gain and Saxo platforms.

CW1 described how, in late 2014, he and other FXCM officers had warned Brendan Callan, back then – the FXCM CEO of Europe, and Niv’s direct report for Europe’s operations, about the massive risks of the EUR/CHF customer accounts. As CW1 explained, “I said to them ‘here’s something piling up, it’s getting worse and worse and we should take care because if that 120 peg is removed, it [i.e., the euro’s value] will drop dramatically.”

Callan replied, “you take care of your sales; the risk is being managed by the Dealing Department, which you’re not a part of.”

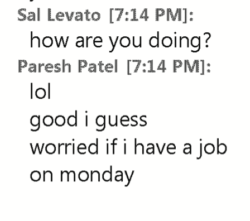

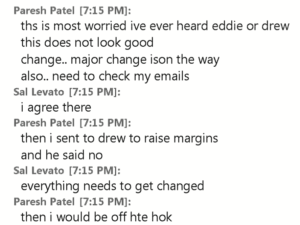

Testimony of Paresh Patel, FXCM’s head trader, and excerpts from his chat with another FXCM employee, add to evidence that Drew Niv was aware of the possible problems with CHF pair leverage. On January 16, 2015, Mr Patel says he needs to check his emails, adding that “then I sent to Drew to raise margins and he said no”.

Furthermore, Patel elaborates on the losses calculation, saying that “2b times 15 move is 300m. They didn’t think it was that bad.” In their complaint, the plaintiffs note that FXCM’s exposure was actually $2.2 billion on January 14, 2015, the day before the SNB event, more than double the approximately $1 billion Defendants stated after the fact. Patel’s estimates are seen as proof for the misleading estimates provided in FXCM’s press releases following the January 15, 2015 events.

The rest of Patel’s testimony provides more details to the overall mood at FXCM following the “Black Thursday” events, including the concerns of employees about keeping their jobs.