Blockchain/Bitcoin rank in top three most discussed topics by Irish consumers on social media

In the second half of 2016, the Central Bank of Ireland observed a total of 3,716 online mentions relating to financial products and services in Ireland – an average of 143 mentions per week.

Blockchain and bitcoin were amid the most discussed topics on social media in the second half of 2016, according to the latest Consumer Protection Bulletin published by the Central Bank of Ireland.

During the July – December 2016 period, the regulator gathered data on consumer experiences by monitoring social media and online trends regarding financial services and products. The bank observed publicly available social media platforms, blogs and online content such as webpages and forums. These were monitored in real-time against a list of about 50 key words.

In the second half of 2016, the Central Bank registered a total of 3,716 online mentions relating to financial products and services in Ireland, which gives a weekly average of 143 mentions.

The large majority of the mentions (84%) expressed dissatisfaction with financial products/services.

Most of these expression of dissatisfaction concerned account administration (69.1%), followed by customer service (12.7%) and fees and charges (9.4%). Across sectors, banking accounted for 98.2% of mentions expressing dissatisfaction.

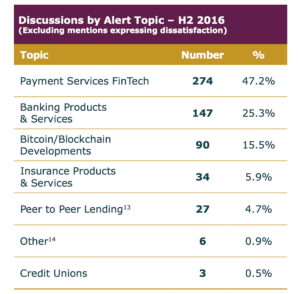

Excluding mentions that expressed of dissatisfaction, the highest number of mentions related to technological developments (FinTech) in payment services (47.2%). The second highest number (25.3%) related to discussions around banking products and providers, whereas the third highest number (15.5%) related to conversations around Bitcoin and Blockchain technologies.

Excluding mentions that expressed of dissatisfaction, the highest number of mentions related to technological developments (FinTech) in payment services (47.2%). The second highest number (25.3%) related to discussions around banking products and providers, whereas the third highest number (15.5%) related to conversations around Bitcoin and Blockchain technologies.

We are curious to see how (and whether) the perception of Bitcoin changes in the first half of 2017, as this crypto currency has become a means used by cybercriminals to blackmail victims. The latest example is, of course, the WannaCry virus.

The social media activity monitoring is a useful tool for the Central Bank when challenging firms on the concerns raised by their customers and enabling supervisory interventions. Some of these mentions have actually resulted in the Central Bank issuing public warnings.

The regulator is seeking to bolster investor protection. In March this year, the Central Bank of Ireland published a Consultation on the protection of retail investors in relation to the distribution of CFDs. One of the options outlined in the document is the prohibition of the sale or distribution of CFDs to retail clients in and from Ireland. The consultation is open until May 29, 2017.