Boston Technologies founder George Popescu heads into media; Becomes CEO and Chief Editor of Lending Times

Serial academic and fintech entrepreneur George Popescu has this week embarked on his latest venture by founding a website which reports daily news, analysis and data for peer to peer (P2P) and marketplace lending executives. Under the name Lending Times, Mr. Popescu adds a journalistic aspect to his existing interests in venture capital provision to startups […]

Serial academic and fintech entrepreneur George Popescu has this week embarked on his latest venture by founding a website which reports daily news, analysis and data for peer to peer (P2P) and marketplace lending executives.

Under the name Lending Times, Mr. Popescu adds a journalistic aspect to his existing interests in venture capital provision to startups as he is currently a partner in LunaCap Ventures, which is a venture-debt investment company.

Well connected in the fintech industry, Mr. Popescu is an adviser at Bitcoin brokerage Alt-Options in Boston, Massachusetts, as well as being a Startup Mentor at Massachusetts Institute of Technology.

Mr. Popescu is a very well known figure in the FX industry having held the position of CEO at Boston Technologies since his founding of the company in 2007, leaving in February 2015.

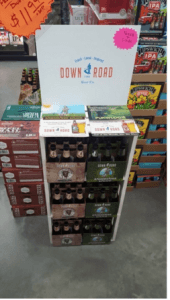

In addition to his fintech ventures and interest in startups, Mr. Popescu founded a boutique brewery in Everett, Massachusetts which is a fresh diversion indeed!