Brokers gain market share by increasing analyst headcount and experience, study finds

“What is also clear, is that brokers that increase both their analyst headcount and average experience levels in their teams are guaranteed to increase market share from their previous positions.”

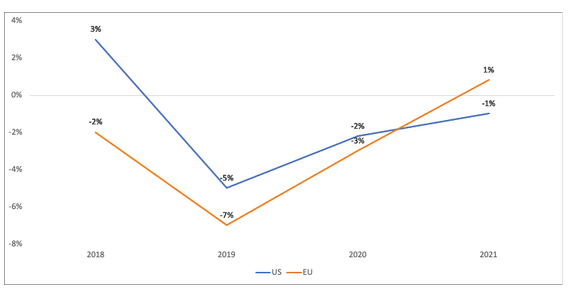

Since MiFID II came into effect, in proportionate terms, European brokers had shrunk their analyst teams at least three times more than their US counterparts, according to a 2020 study conducted by Substantive Research.

The report concluded there had been a 12% loss of analysts in Europe vs a 4% loss in the United States on account of decreased budgets among buy side firms globally but more significantly in Europe.

Now, the latest equity Analyst Mapping study, covering data spanning the first three quarters of 2021, shows that the brain drain in investment research has stabilized.

Brain drain in investment research decelerates

Study findings show that the brain drain in investment research has rapidly decelerated in 2021, with only 296 years of net experience lost to the supply side of the market globally, compared with almost 7,500 over the previous 3 years.

As to analyst headcount, Europe has now stabilized with an increase of 1% in 2021, coupled with net 45 years of experience lost compared to analyst team headcount in the US which has decreased by 1%, with a net loss of 251 years of experience in the market.

The post-MiFID II shock initially hit all providers similarly in terms of lower research payments. The now fragmented market has each broker having its own unique experience in terms of its pricing power and ability to commit to quality and coverage from a cost perspective.

The buy side’s research valuation processes get more rigorous and their remuneration for external research is much more sensitive to changes in quality and resourcing by brokers, the report stated.

Retaining senior analysts – Broker market share

Mike Carrodus, CEO of Substantive Research, commented: “In 2021 we saw broker research cost-cutting stablising overall. This has been driven by a subset of brokers retaining and hiring senior, quality analysts which has offset continued cuts among other sell side firms. The buy side’s research valuation processes have matured in the last three years and now ensure that payments quickly reflect changes in quality and breadth of coverage. They are tracking and rewarding broker commitment to investing in the sector coverage they care about most within each broker.”

“What is also clear, is that brokers that increase both their analyst headcount and average experience levels in their teams are guaranteed to increase market share from their previous positions. However, increasing headcount without an accompanying rise in experience is not correlated with larger payments from clients.”

Brokers which have stuck to robust pricing structures and have taken the opportunity to grow teams with quality analysts are now seeing the rewards in terms of market share.

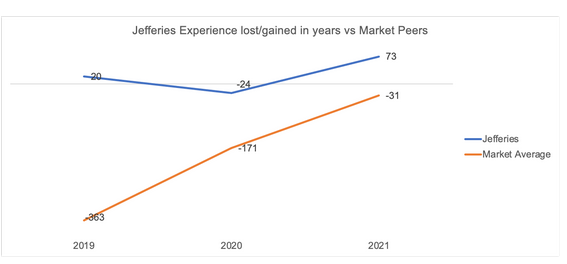

According to the report, Jefferies is an example of the high correlation between investment in retaining senior analysts and broker market share.

Jefferies increased analyst headcount in 2019 and 2020 against the overall market trend and increased experience by a net 73 years, versus an industry average of a net loss of 31 years.

At the same time, the broker jumped into the top 10 research brokers by market share in payments during 2020, and rose to 7th position during 2021 despite strong competition and significant market churn around them.

In March 2021, Substantive Research released its second Analyst Mapping study, covering the movements in experience levels amongst sell side equity research analyst teams, from Jan 2018 – Dec 2020. The results painted a clear picture of a market that had undergone significant retrenchment in tenure, with nearly 7,500 years of net analyst experience lost to the market during that time period.