CBA clients have rough start of the week due to problematic online transactions

There is an issue affecting some Visa card transactions and some payments in NetBank and CommBank apps.

Customers of Commonwealth Bank of Australia (ASX:CBA) are having a rather troublesome start of the week, as tech issues have plagued online transactions. The issues affect Visa card transactions and payments in NetBank and CommBank app. Putting it otherwise, online payments are hard or impossible to carry out.

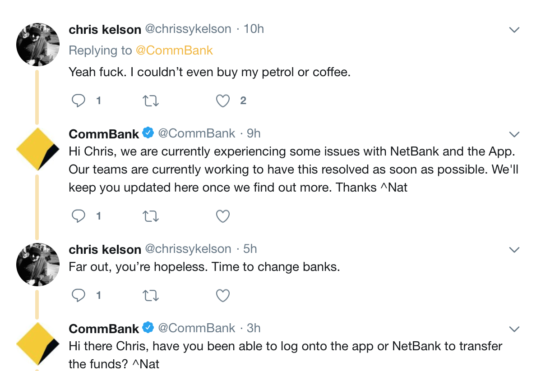

The bank confirmed the problems early today, stating on its Twitter account:

“Morning everyone. We’re aware of an issue affecting some Visa card transactions and some payments in NetBank and CommBank app. We’re working to fix as a priority and we apologise for any inconvenience first thing on a Monday”.

Clients of the bank complained about being unable to get to their workplaces as they were unable to pay for transportation. The frustration about being unable to pay for a cup of coffee on Monday morning, to pay one’s bills or to conduct business added to the frustration of CBA’s customers.

About 8 hours after the initial confirmation of the outage, CBA said that:

“Transfers and payments are now working in NetBank and the CommBank app. As we restore services some users may experience log-on taking a little longer than normal. We’re sorry – we realise this isn’t the best start to a Monday and we appreciate your patience”.

“We’re aware that some customers may continue to experience issues logging into NetBank and the CommBank app. We understand this is very frustrating and we apologise – we’re working to restore services as soon as we can”.

In fact, many of the clients report persisting problems.

The situation is similar to what European Visa cardholders experienced on June 1, 2018. Customers were prevented from using Visa for payments for more than 16 hours. Visa said the issue was the result of a hardware failure within one of its European systems and was not associated with any unauthorised access or cyberattack.