Cboe Global Markets registers rise in FX net revenues in Q4 2018

Although revenues staged a rise in the final quarter, the net income fell 46% against the year-ago quarter.

Cboe Global Markets Inc has earlier today posted its key financial metrics for the final quarter of 2018.

Global FX net revenue amounted to $13.7 million in the fourth quarter of 2018, up $1.7 million or 14% from the year-ago quarter. The rise primarily reflected higher net transaction fees compared with the fourth quarter of 2017. ADNV traded on the Cboe FX platform was $35.1 billion for the quarter, up 8% from the fourth quarter of 2017. In addition, Cboe FX market share increased to 15.3 % from 14.9% in the final quarter of 2017.

Across all segments, net income amounted to $137.3 million in the final quarter of 2018, down 46% from the final quarter of 2017. Cboe did not elaborate on the drop but mentioned that income tax expense of $37.3 million for the fourth quarter was $190.3 million higher than in the year-ago quarter primarily due to the tax benefits recognized from the enactment of corporate tax reform in 2017.

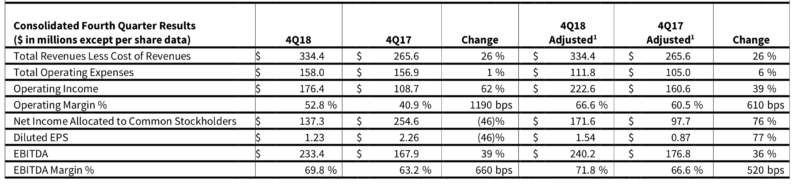

Total revenues less cost of revenues were $334.4 million in the fourth quarter of 2018, up 26% from $265.6 million in the prior-year period, reflecting growth in each business segment.

Total operating expenses were $158.0 million versus $156.9 million in the fourth quarter of 2017. Adjusted operating expenses were $111.8 million versus $105.0 million in the fourth quarter of 2017, primarily reflecting an increase in compensation and benefits as a result of increased financial performance.

Operating income grew by 62% to $176.4 million and adjusted operating income grew by 39% to $222.6 million. The operating margin for the fourth quarter was 52.8%.

In terms of outlook, Cboe forecasts that, during the 2019 fiscal year, its adjusted operating expenses will be in a range of $420 to $428 million, representing a projected decline of 2% to a nominal increase compared to 2018’s adjusted operating expenses of $426.8 million. The guidance excludes the amortization of acquired intangible assets of $138 million.

Capital expenditures are expected to be in the range of $50 to $55 million.