Clock starts ticking for FXCM, as NFA decision becomes effective

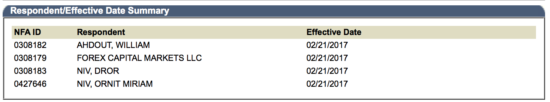

The NFA decision that bars FXCM Inc, as well as Drew Niv, Ornit Niv and William Ahdout from membership, becomes effective today.

It has been two weeks since US regulators published their findings into the activities of FXCM Inc (NASDAQ:FXCM), with the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) barring the broker, as well as a number of its principals – including Drew Niv and William Ahdout, from membership.

Many must have wondered why the broker’s US operations are still active, given latest regulatory action and the fact that FXCM’s US retail FX client accounts are about to be transferred to GAIN Capital’s Forex.com later this week. Indeed, FXCM has promised assistance in the transition but the bigger reason is that FXCM Inc still has time to put the NFA decision into practice.

The NFA decision regarding FXCM and its principals was published on February 6th, but its effective date is February 21st – today.

It is from today on that the clock is actually ticking for FXCM Inc, Drew Niv, Ornit Niv and William Ahdout. They have up to 15 days to implement regulatory orders. Of course, they can implement these orders as early as today. But the NFA website shows no formal change in the registration of FXCM Inc or its principals.

In the meantime, Drew Niv’s status in the UK financial services industry, as per the FCA Register, is “inactive”. Mr Niv has left Lucid Markets and Forex Capital Markets Limited (FXCM UK). FXCM, however, has insisted that its non-US business will not be affected by the US developments and will continue to operate normally. That did not serve as much of a consolation to French traders, as some of them have mobilized again FXCM France and are seeking lawyers’ assistance.

Legal action against FXCM Inc in the US is already gathering pace, with dozens of proposals from law companies targeting shareholders of the broker, offering them to join class action lawsuits and claim compensations.