CQG releases new version of desktop platform

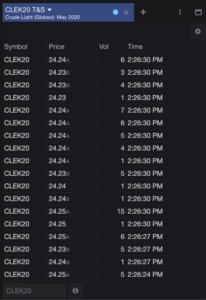

The latest version of the platform offers a single symbol T&S widget and the ability to show more decimal points for all studies.

Provider of high-performance trading, market data, and technical analysis tools CQG has released a new version of its desktop platform. Version 5.2 of CQG Desktop offers a raft of enhancements concerning quotes and charting.

Traders can launch the single symbol T&S widget from the Quotes group, single symbol section. It will open using the last used symbol. Traders can change the symbol using the symbol entry in the bottom bar, or use window linking.

Traders can launch the single symbol T&S widget from the Quotes group, single symbol section. It will open using the last used symbol. Traders can change the symbol using the symbol entry in the bottom bar, or use window linking.

Like the Time & Sales: Portfolio widget, traders can filter by bids, asks, trades, and traded volume as well as rearrange columns.

The new version of the platform gives traders the ability to show more decimal points for all studies. In the Modify Study dialog, a new parameter is available for all studies to show additional decimal points.

A new chart type is introduced – Volume Candle.

Traders can also make use of DMIwADX study: ADX curve can now share scale with DMIu, DMId, and FFID.

Thanks to the preceding release of CQG Desktop, users got the ability to view volume profile on HOT. In the HOT widget, go to the task menu and select “Show Volume Profile (session)”. In CQG IC, this setting is called Total Volume Column with additional settings for day or session. In CQG Desktop session volume has been implemented.

Traders also get the ability to modify iceberg visibility of working orders. When traders have a working iceberg order, they can now modify the visible size from the Modify order dialog.