cTrader goes all out on marketing tools for brokers – Here are the details

Spotware Systems has today announced the introduction of 3 new marketing tools which have been made available to brokers. These are; Dividends Payments for Equity CFDs, Dynamic Commission Discounts and Bonuses functionalities to cTrader and cBroker. “Following our November 2015 cTrader updates we have supported these 3 key additions to our product suite which provides […]

Spotware Systems has today announced the introduction of 3 new marketing tools which have been made available to brokers.

These are; Dividends Payments for Equity CFDs, Dynamic Commission Discounts and Bonuses functionalities to cTrader and cBroker.

“Following our November 2015 cTrader updates we have supported these 3 key additions to our product suite which provides new ways for brokers to align our platforms with their marketing strategies all of which are configurable from their Group settings in cBroker.” said James Glyde, Business Development Manager at Spotware Systems.

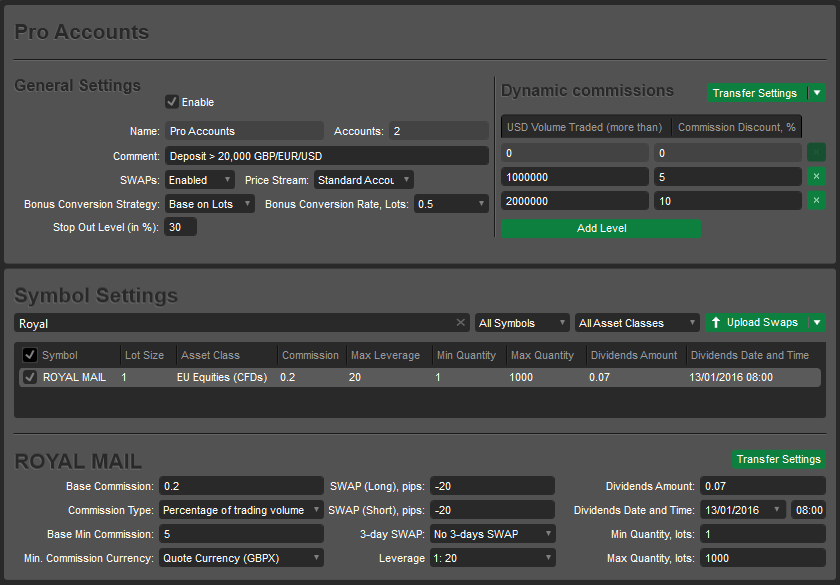

The cTrader Suite is already renowned for not imposing any limitation on the number of symbols brokers can offer, which could potentially be in the thousands as already exercised by some brokers. To expand on this; brokers can now automatically pay or collect dividends on their equity CFD offering in the form of a deposit or withdrawal to all traders with open positions of that equity at the time of dividend payment, as configured by the broker. All long positions will receive the dividends as a deposit and all short positions will pay the dividend as a withdrawal. Brokers can set the exact amount of the dividend and the time and date it will occur. Traders will see exactly which position the deposit/withdrawal correlates to.

“This tool further strengthens cTrader as a Multi Asset Class trading platform and adds to a variety of tools available from cBroker which allow brokers to totally customize their symbols and how they are delivered through the cTrader platforms” James Glyde, Business Development Manager

Brokers can now create a dynamic commission discount structure which can be applied on a per group basis, meaning the same structure can be set for all asset classes within the same group. The discount is applied as percentage so it will be applicable to all three commission types. Available commission types are USD per million USD volume, USD per lot and percent of trading volume.

A number of discount levels can be created; brokers can select what volume the trader needs to achieve to receive a predetermined discount from the charge applied according to the broker’s commission in Groups settings which will apply for the following calendar month. Brokers are also able to apply a minimum commission for each symbol as a layer of protection from misconfigured or inconsistent settings. Traders will receive a newly introduced notification type

which will be co-branded with their broker and cTrader. Traders are notified each time they hit one of the thresholds and what their commission discount will be for the next calendar month.

-more-

“This is, in my opinion one of the best reward schemes you can offer to your high volume traders, producing a welcome incentive to attract and retain these valuable traders to any brokerage!” James Glyde, Business Development Manager

Brokers can now offer bonuses to their traders which may be converted into balance according to their Group settings. This Bonus functionality has been designed to guarantee no manipulation is possible from either party. cTrader bonuses have been designed in a manner so they are completely risk free for the broker and add no additional risk to the trader.

“We are very pleased to offer this best-in-class bonus functionality, of which we are certain is the best for traders, brokers and on the market. It is a built in feature of our product suite and now issued as standard to all future and existing cTrader brokers. This new functionality goes side by side with our soon to be released IB Program, as IBs can also give bonuses to their introduced clients to incentivize trading and retain clients.” James Glyde, Business Development Manager.

Traders can receive bonuses of any size but cannot utilize the full amount of the bonus if it is greater than their cash equity. Traders can only use bonus equal to or less than their cash equity. If the traders cash equity decreases so does the amount of bonus that can be accessed. Bonuses are added to a trader’s equity; therefore they are used in conjunction with their cash equity to open positions and cannot be used instead of cash equity. Brokers are able to make bonuses convertible by setting the requirements to convert $1 of bonus into balance. Conversion criteria can be based on a set number of lots or volume and can be configured on a per group basis.

Traders can view their bonuses from the Bonus Manager inside cTrader, this can be found as a newly introduced tab along the Deal Watch section of the platform, from here they can view their total bonus, active bonus, the criteria to convert their bonus into balance and their total realized converted bonus. The Bonus Manager clearly shows each bonus that was received as a deposit, with an ID number and bonus which was converted into balance as a withdrawal from available bonus which is deposited to the Traders balance as a deposit, the source of this deposit is clearly indicated as “Bonus Conversion”.

Featured photograph: James Glyde meets Andrew Saks-McLeod in Limassol, Cyprus. Copyright Andrew Saks-McLeod