Cypriot regulator reverses stance about authorization of Centralspot Trading

CySEC has decided to recall the suspension of the CIF authorisation of Centralspot Trading Ltd.

The Cyprus Securities and Exchange Commission (CySEC) has changed its stance regarding the authorization of Cyprus investment firm (CIF) Centralspot Trading.

At its meeting held on November 18, 2019, the Cypriot regulator decided to recall the suspension of the authorisation of Centralspot Trading, number 238/14, pursuant to section 9(3)(a) of Directive DI87-05 for the Withdrawal and Suspension of Authorisation. CySEC explains that it has been satisfied that the company has complied with:

Article 92(1) of Regulation (EU) No. 575/2013 on prudential requirements for credit institutions and investment firms (‘the Regulation’), in relation to its capital ratio.

Article 93(1) of the Regulation, in relation to its own funds.

Earlier in November, when CySEC announced the suspension of the CIF license of the company, the regulator said the law violations committed by the firm are seen to seriously endanger the interests of the company’s customers and the proper functioning and integrity of the market.

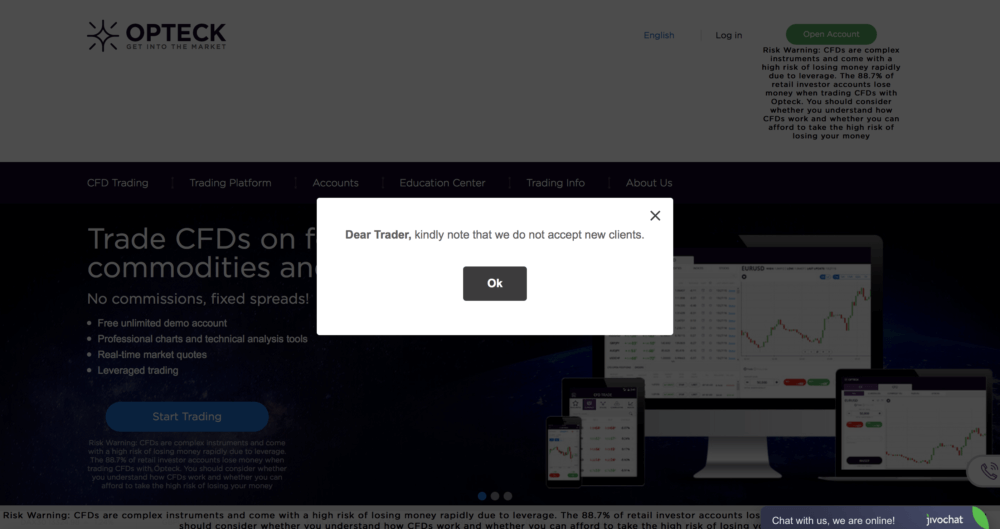

Throughout the suspension of its license, the company was not allowed to provide/perform investment services/activities, nor to establish a business relationship with any person and accept any new clients. The company was also not allowed to advertise itself as an investment service provider.

As per CySEC’s website, Centralspot Trading Ltd operates under two brands: CFD trading firm Opteck and trading software firm FXVC. The websites of both entities are up and running at the moment of publication of this article. Opteck’s website shows a warning that the firm does not accept new clients.