Cyprus underperforms in terms of STOR supervision, according to ESMA report

According to the report, the setup to supervise the STOR Framework in Cyprus is incomplete (no written procedures, limited engagement, no on-site visits, no assessment of gaps/trends).

The European Securities and Markets Authority (ESMA) has earlier today published a peer review report on how national competent authorities (NCAs) handle suspicious transactions and order reports (STOR) under the Market Abuse Regulation (MAR).

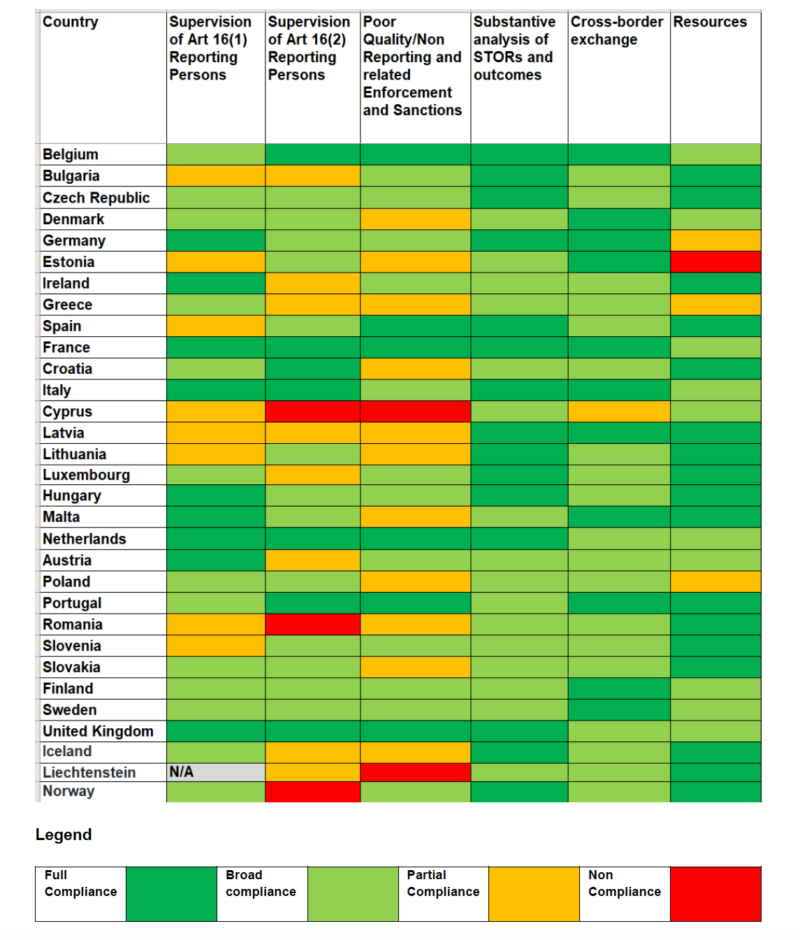

The ESMA peer review assessed all 31 NCAs in six areas to evaluate the effectiveness of their STOR supervision. ESMA concluded that, overall, NCAs are performing well in the analysis of suspected market abuse reported in STORs which has been facilitated by close cooperation and sharing of practices amongst NCAs. However, the regulatr also identified some areas for improvement in NCAs’ supervision and enforcement of the STOR requirements.

Overall, six NCAs were assessed as fully complying in at least four of the six assessment areas, namely those from Belgium, France, Italy, the Netherlands, Portugal and the United Kingdom.

In the areas identified for improvements, there are 13 NCAs which were assessed as partially compliant (Croatia, Denmark, Estonia, Greece, Iceland, Latvia, Lithuania, Malta, Poland, Romania and Slovakia); or non-compliant (Cyprus and Liechtenstein) in their response to poor-quality or suspected non-reporting of STORs and associated enforcement actions.

Cyprus showed the worst results.

The report finds that, in general, the setup to supervise the STOR Framework is incomplete (no written procedures, limited engagement, no on-site visits, no assessment of gaps/trends) in Cyprus. Although, some positive activity is present (Q&A, circulars, reminders, ad hoc feedback and a general letter issued to Reporting Persons at the end of the Review Period requesting details of systems to detect STORs which suggests this was not considered at authorisation), there is limited engagement with Art. 16(2) Reporting Persons.

The report authors say Cyprus needs to proactively engage with Art. 16(2) Reporting Persons through supervision at authorisation stage and on-site visits as well as more desk-based supervision and building on work started at end of Review Period.

Further, it is recommended that Cyprus develops an internal written procedure and systems to challenge non-reporting STORs. Cyprus also needs to have engagement with Reporting Persons to deal with poor quality and non-reported STORs issues and has to ensure it maintains a log of poor quality/non reporting to determine escalated supervisory response in appropriate cases.

The report also notes the relatively high number of STORs still pending/unknown in Cyprus.

Another recommendation is that Cyprus has to ensure Reporting Persons can detect suspicious activities that may be relevant for other NCAs and use relevant complaints to challenge Reporting Persons’ detection systems.

National regulators may express their view on the outcome of the peer review report in a statement. The Cyprus Securities and Exchange Commission (CySEC) has issued a statement on the outcome of the peer review report.

CySEC disagrees with some of the findings and assessments made by the Peer Review Assessment Group. According to the Cypriot regulator, “the Peer Review Assessment Group did not pay sufficient consideration to the specific characteristics of the Cyprus market, which in our view renders our approach justified and proportionate”.

CySEC finds that the peer review has not adequately considered the supervision of the two reporting persons under article 16(1) of the Market Abuse Regulation (“MAR”). In particular, only two trading venues operate in Cyprus, both operated by the Cyprus Stock Exchange. CySEC has a real-time monitoring tool for the effective supervision of the regulated market. In addition, CySEC has direct access to the central securities depository data, the Cypriot regulator says.

Further, CySEC argues that “the peer review has not adequately taken into consideration the specific characteristics of the Cyprus Investment Firms that make up the majority of the article 16(2) of MAR reporting persons”. CySEC stresses that the majority of the Cyprus Investment Firms offer investment services in relation to financial instruments which fall outside the scope of MAR (163 out of 248 investment firms in 2018). Moreover, the supervisory actions taken by CySEC are considered proportionate, in view of the fact that CySEC follows a risk-based supervision framework.

Also, CySEC considers that the peer review has not adequately taken into account the specific characteristics of the Cyprus market that justifies the limited number of STORs received. During the period under review, no poor quality STOR was identified among the limited number of STORs received. In addition, CySEC provided information indicating the fact that proactively deals with potential cases of non-reported STORs. It is noted that during the review period no cases of non-reported STORs were identified. The Cypriot regulator also stresses that it maintains an internal log with detailed information regarding the STORs received. This log has been further updated and includes incidents of poor quality STORs/non reported STORs that arose after the review period.

Finally, with regards to cross-border exchange, CySEC points out that it transmits STORs in a prompt manner to other EU National Competent Authorities, and that it uses alternative tools to ensure that reporting persons can detect suspicious activities that may be relevant for other NCAs.