Devexperts Expands London Team with Four Key Hires to Meet Growing Demand in Trading Technology

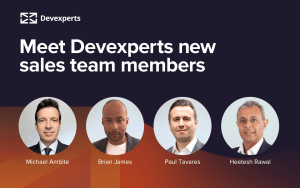

Devexperts, a leading provider of software solutions to financial firms, is delighted to announce the expansion of its London team through the addition of four seasoned professionals. Paul Tavares, Brian James, Michael Ambite, and Heetesh Rawal join the team to drive client-centric solutions and cater to the surging demand in the trading technology sector, leveraging their extensive industry experience and skillset.

These four individuals, Michael Ambite, Paul Tavares, Brian James, and Heetesh Rawal, will take on roles as Vice Presidents of Sales and Business Development. Together, they bring over 70 years of collective expertise in market data and fintech domains. Notably, Michael Ambite boasts a career spanning 27 years, having worked with industry giants like Thomson Reuters, Bloomberg, and the GTN Group. Tavares, previously Director of Account Management (EMEA) at Exegy, contributes over 15 years of experience in market data and technology, having collaborated with some of the world’s leading investment banks and financial institutions.

Brian James, with 18 years of experience in financial markets, has a comprehensive background including roles at Exchange Data International (EDI) and FIS. He has worked closely with custodians, investment banks, hedge funds, asset managers, brokers, and data vendors across Asia, Europe, and North America. Heetesh Rawal, previously Global Key Account Director at Options Trading, brings over 16 years of specialized knowledge in low-latency trading infrastructure, market data, and exchange connectivity. Throughout his career, he has excelled in devising and implementing complex solutions to address various client challenges, including overseeing significant outsourcing deals in the front-office managed infrastructure space.

The increased interest in Devexperts’ customizable off-the-shelf and bespoke brokerage solutions has prompted this expansion of the business development team. Each of the new hires enriches the team’s capabilities, reinforcing Devexperts’ commitment to delivering high-quality solutions to brokers, exchanges, and the wealth management sector.

Michael Babushkin, Global CEO of Devexperts, remarked, “Paul, Brian, Michael, and Heetesh join us at a time when we are witnessing heightened demand for our off-the-shelf solutions, which can be white-labelled and tailored as our clients expand. This option provides startups with the means to swiftly enter the market, a unique offering in the software vendor landscape. We provide a comprehensive array of tools and partnerships with an open-platform architecture optimized for seamless integration into brokers’ existing solutions, equipping them to build end-to-end trading systems.”

Devexperts has been at the forefront of developing and supporting trading and investment software for retail and institutional brokerages, exchanges, and wealth management firms since 2002. Their SaaS trading product offers an intuitive, modern platform for investors, alongside a sophisticated automated trading and risk management platform for brokers.

About Devexperts: Devexperts has been a pioneer in developing financial software for the capital markets since 2002. The company specializes in multi-asset trading platforms, matching engines, and exchange solutions. Their flagship solution, DXtrade, is a versatile trading platform catering to equities, derivatives, Forex, CFDs, spread betting, FX options, and cryptocurrency trading. Devexperts serves a wide range of clients, including retail and institutional brokerages, wealth management firms, investment funds, and exchanges. Their global development team comprises 800 engineers across multiple international offices. For further information, please visit Devexperts’ official website.