Digital assistants advance in financial services sector, as PostFinance launches chatbot

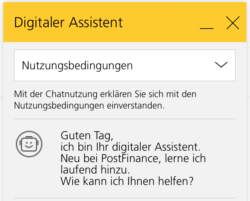

The chatbot, which currently operates only in German, is capable of answering basic questions concerning PostFinance services.

Digital assistants, whose operations are unrestricted in time, are increasingly adopted by financial services companies. The latest example comes from Switzerland, where PostFinance has deployed a virtual assistant on its website.

The chatbot, which currently operates in German only, is available around the clock and generates automatic replies to customers’ most frequently asked questions. FinanceFeeds’ managing editor tested the bot with a number of questions about the key operations of PostFinance and how the company may assist her. The robot indeed answered precisely and politely.

The solution was developed by IT services firm ELCA and is based on Nuance’s standard product “Nina Web”. Various additional services which have only just been developed have been set up to process natural language. These services aim to optimize the virtual agent’s speaking comprehension, improve dialogue management, provide more context and improve its ability to process enquiries.

The solution was developed by IT services firm ELCA and is based on Nuance’s standard product “Nina Web”. Various additional services which have only just been developed have been set up to process natural language. These services aim to optimize the virtual agent’s speaking comprehension, improve dialogue management, provide more context and improve its ability to process enquiries.

Sylvie Meyer, Head of Retail and a member of PostFinance’s Executive Board, says:

“PostFinance wants to make it as easy as possible for their customers to manage their money and their financial affairs in general. Because the virtual assistant answers repetitive questions automatically, our customers receive information quickly and at consistently high quality. This means that our staff at the Contact Center can focus their attention on more complex customer concerns”.

In order to train the bot, PostFinance regularly feeds new content to the virtual assistant based on the questions asked. In addition, it continues to learn over time thanks to feedback from users. It currently recognizes three quarters of all enquiries from the initial contact and is able to give the customer a suitable answer.

The company is now proceeding to the bot’s next stage of development. It will be equipped with more capabilities and will be more closely integrated into PostFinance’s existing systems.

Talking of Swiss financial services providers embracing virtual assistants, let’s recall that in October this year, Swissquote‘s mobile app for Android devices got equipped with a chatbot.