DMM Bitcoin adds biometric authentication to further bolster cyber security

Clients of the virtual currency exchange can use biometric authentication on their Android devices.

DMM Bitcoin, the virtual currency business of Japanese Internet giant DMM.com, is seeking to bolster cyber security via the introduction of biometric authentication for its customers.

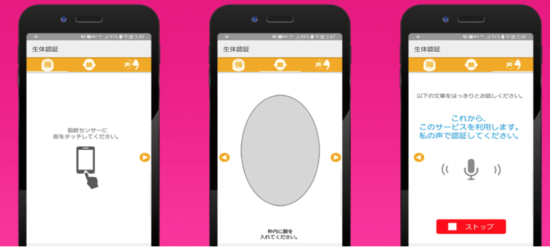

In a notice on its website, the company explains that the biometrics authentication, which is available via the Polarify app for Android devices, will enable customers to login using their voice, face, or fingerprints. The company has already implemented 2-factor authentication, along with SMS and e-mail authentication methods.

With regard to the introduction of two-factor authentication using the biometrics for iOS devices, the company said it was actively preparing itself for the introduction of such a solution.

Online security is important to DMM Bitcoin. Earlier this month, the company said it would end support for older Transport Layer Security (TLS) protocols, effective August 29, 2018.

In a notice to its clients, DMM Bitcoin said it will invalidate the Internet communication encryption method “TLS 1.0 and 1.1”. After August 29, 2018, the company’s web service and trading system will be unavailable on PCs, smartphones, tablets, browsers, etc. that do not support “TLS 1.2”. Let’s note that the security strength of TLS 1.2 is higher than that of TLS 1.0 and TLS 1.1.

Customers are asked to check their devices’ settings in order to make sure that they can continue to use the company’s services.

The cryptocurrency industry has seen frequent reports about hacks, so it is not surprising that DMM Bitcoin is paying so much attention to cyber security. In January this year, Coincheck suffered an “incident” that saw the theft of JPY 58 billion worth of NEM digital money from the exchange.

About a week later, the Japanese authorities issued a business improvement order to Coincheck. The Financial Services Agency (FSA) ordered the company to determine the facts and causes of this case and to issue proper response to customers. In addition, Coincheck was instructed to strengthen the management control of its risk management system and to clarify who bears the responsibility for the theft. The company will also have to formulate measures to prevent recurrence of the incident.