Eightcap clarifies ties with prop firms, The5ers pauses US trader sign-ups

Eightcap CEO Alex Howard has come forward to set the record straight amid a flurry of speculation regarding their business with prop firms. Meanwhile, prop trading firm The5ers announced a major shift in its approach to US traders.

Just yesterday, the news circulated that MetaQuotes’ stricter approach has led to ceasing services by several prop firms. Matt Lark, CEO of prop firm Lark Funding, revealed via a tweet that Australian broker Eightcap will stop serving his company and other proprietary trading firms by February 29.

Lark added that while Eightcap’s decision is a setback, they’ve received reassurances from ThinkMarkets about their operations and “solid relationship” with MetaQuotes.

In a Linked post today, Alex Howard, Chief Executive Officer of Eightcap, has addressed the swirling rumors and statements concerning the brokerage’s recent decisions. Howard said he was disappointed over the misleading narratives being circulated about Eightcap’s activities, citing the lack of a fair opportunity for the company to comment on these matters. He clarified that reassessing and terminating commercial partnerships are routine aspects of their business operations, aligning with industry norms.

Despite the cessation of certain relationships, Howard reaffirms, “It’s business as usual for us,” highlighting Eightcap’s ongoing commitment to the CFD, Forex, and Prop industries.

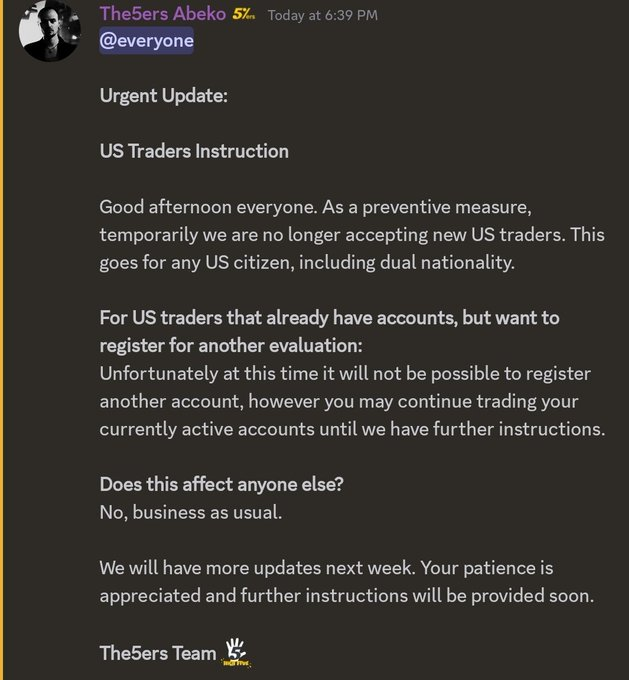

The5ers’ Decision on US Traders

In response to the uncertain regulatory environment, The5ers prop trading firm announced a temporary halt on onboarding any new US traders. The company explained that this pause is a precautionary measure to ensure full compliance with the legal frameworks governing US individuals’ participation in proprietary trading.

Affected prop firms that use Eightcap may include names like Blue Guardian, Funded Trading Plus, and The Funded Trader. Among those relying on ThinkMarkets are AquaFunded, Bespoke, Forex Capital Funds, Goat Funded Trader, Instant Funding, Lark Funding, Ment Funding, My Flash Funding, My Funded FX, Skilled Funded Traders, Swift Funding, The Funded Trader, and

Earlier last week, retail prop trading tech provider FPFX Technologies, LLC (FPFX Tech), terminated its licensing agreement with the prop firm Funded Engineer following an internal audit. The prop unveiled what the vendor alleges to be “a months-long scheme” by Funded Engineer to deceive both FPFX Tech and the public by inflating payout figures through illicit activities.

However, Funded Engineer defended itself and claimed that Purple Trading is actually suspending MT4 and MT5 services for all prop firms, noting that this change affects the entire prop firm community.

A day earlier, another prop trading firm called True Forex Funds announced a “temporary halt” to its services. The company said this move comes in the wake of MetaQuotes, the developer of the widely-used trading platforms MT4 and MT5, terminating True Forex Funds’ licenses.

This incident came hot on the heels of the shutdown of Canada’s My Forex Funds by US and Canadian regulators last September.