Email is a thing of the past, says TradingView, as Customer Support 2.0 launches

TradingView users can report problems directly from the platform interface and receive speedy replies right in the system.

Customer support is an essential element of any company, with TradingView, a popular charting resource for active traders, providing us with an interesting example on how the customer support service evolves.

Today, TradingView announced the launch of Customer Support 2.0, which allows the company to bid goodbye to emails.

“Email is a thing of the past. It’s slow, outdated and increases response time”, TradingView says.

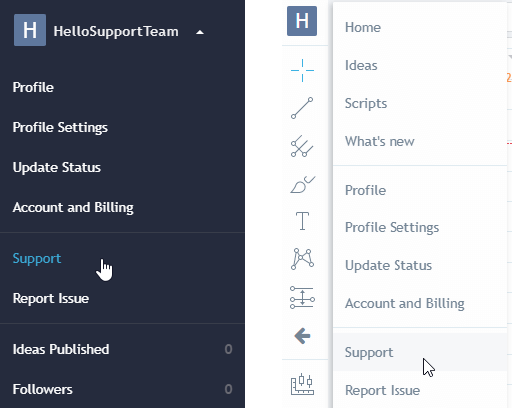

So, there is no more email support. Instead, users can ask questions and report problems directly from the platform interface and receive timely replies right in the system. The point is to let the users avoid checking their inbox and stay focused.

There is new ‘SUPPORT’ tab in traders’ TradingView profile. Every single ticket opened from this moment on is listed there and available for one’s review. The company also kindly reminds users that it has a dedicated Status page on a separate server that shows the current state of all of its services and a log of solved issues. It’s good to check the Status page before sending a report.

In the future, the company aims to enhance the self-help resources and make them really helpful. TradingView already has the GoPro page, TradingView Wiki, and FAQ which are being updated constantly. The company seeks to introduce more advanced ways for users to easily learn about the platform possibilities, and quickly find answers to their questions.

It is apparent that the way traders communicate with the service providers, be those Forex brokers or platform developers, is changing really fast. Let’s note the trend of many customers of Forex brokers flocking to forum-like communities to ask their questions. The IG Community is one particular example of forum-like environment for traders to submit their ideas and get support. OANDA’s fxTrade forum and Swissquote’s Pulse are other examples of the same way of communication between clients and brokers. One of the advantages of this form of communication is that users often get help from other traders and do not have to wait for a reaction from the company itself.