eToro continues acquisition spree, buying Bullsheet

Israeli social trading network eToro has acquired the portfolio management business Bullsheet to further enhance the customer experience through greater visibility into their eToro accounts. The financial terms of the deal were not shared publicly.

The deal marks the broker’s second acquisition in two months, the latest of which was eToro’s purchase of no-fee trading app Gatsby to expand its business in the US. The takeover, which was around $50 million in cash and common stock, was initially filed for approval by the US Financial Industry Regulatory Authority (Finra) back in December 2021.

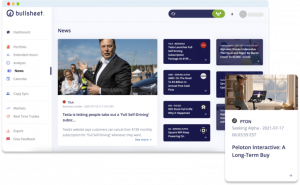

Bullsheet’s portfolio manager is designed exclusively for eToro users who want insightful information about their portfolio without all the manual work of updating their stakes. The platform was launched last year by Portuguese cousins Filipe Sommer and João Ramalho Carlos, who originally joined eToro’s Popular Investor program.

Based on their experience, they innovated portfolio management tools to help eToro users analyse the diversification of their portfolio and visualize assets by sector, type, yield and much more. The service enables them to check stocks during extended trading hours, study P/E, P/S and other ratios to compare their financial data.

“The Bullsheet story is a great example of the talent and passion within eToro’s global community. It’s the wisdom of the crowd in action,” comments Yoni Assia, eToro’s Co-founder and CEO. “We believe there is a power in shared knowledge and that by transforming investing into a group effort we yield better results and become more successful together. João and Filipe share this ethos. They created Bullsheet to share the tools they developed as eToro users with other users. We are excited to welcome them into the eToro team where they will make a strong contribution to our ongoing product development efforts.”

Filipe Sommer, co-founder of Bullsheet, comments: “João and I joined eToro to be part of a community. It was the collaborative mindset of eToro, including the ability to copy other investors that really attracted us to the platform. eToro gave us the ability to interact with millions of investors from around the world. We all share the same goal – we want to learn about the financial markets and become better investors together.”

As part of the deal, eToro will integrate Bullsheet’s offering into its platform and João and Filipe have joined eToro’s product development team. They will support eToro’s goal of integrating user feedback and requests into its product offering.

The recent acquisition comes a few months after eToro laid off 100 employees, half of them in Israel. This number represents around 6% of the company’s total workforce.

At the same time as announcing the cuts, eToro abandoned its plans to go public at an eye-catching $10 billion valuation after it canceled its SPAC deal with Betsy Cohen-backed blank-check firm. Worse still, the social investment work is reportedly in talks to close a private funding round of roughly $1 billion, but at only $5-6 billion valuation.