EURGBP parity is upon us! UK Bureaux de change offering 0.99 EUR against GBP

Some deliverable FX firms have been offering EURGBP exchange rate of almost one to one. Volatility has reversed this to some extent however parity has now been reached at certain points during the trading day

Indeed it may be deliverable FX, however deliverable FX rates are a good indicator of the market value of currency, and can certainly be used for measuring the values of major pairs on electronic trading platforms.

Today, across the UK, certain deliverable FX firms have begun offering the Euro against the Pound on an almost one to one basis. This also means that now, the gap has closed between three majors – the British Pound, the US dollar and the Euro, which are worth very nearly the same as each other, if these rates are any indicator.

Caxton FX, a major British deliverable FX firm, has been offering a rate of 0.9915 Euros to the Pound at Luton and Stansted airports.

FinanceFeeds today spoke to an investor from the UK who is currently purchasing a holiday home in Portugal’s Algarve for the purpose of renting it out to British tourists. He used Caxton FX in order to transfer the capital (170,000 Euros) to purchase the home, and was given a rate of 0.98 Euro to the Pound.

An enquiry at MoneyCorp, another deliverable FX firm by FinanceFeeds today revealed a huge gap between the locations and companies. MoneyCorp offered FinanceFeeds an exchange rate of 1.11541 this evening.

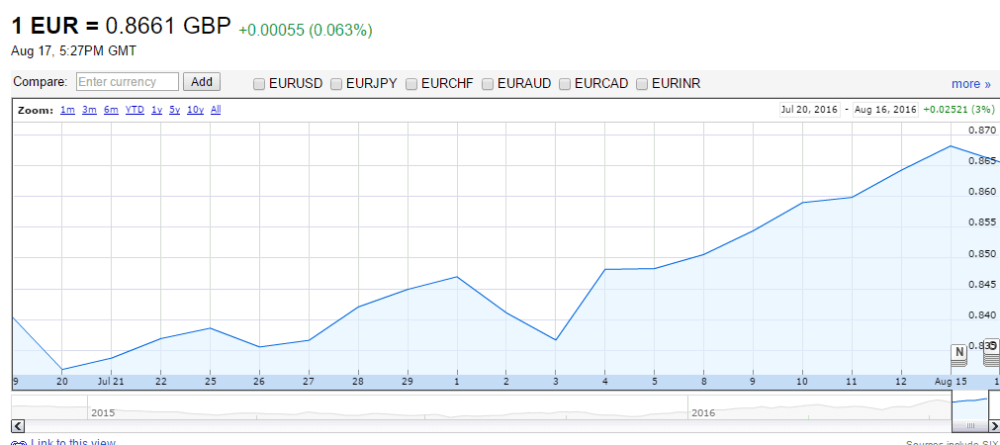

There is a degree of volatility in the EURGBP pair currently, and the Pound has made some ground however it is clear that parity is indeed here at certain points during the trading day and at certain deliverable locations, signalling the lowest GBP value for 3 years.

Indeed, confidence is high in Britain’s post-Brexit future, and it will indeed be interesting to note how long this level pegging with the Euro lasts before the Pound rockets back to strength.