Euronext Reference Shareholders, holding 23.86% of share capital, extend agreement

The Reference Shareholder Agreement was due to expire on June 20, 2019, and is now extended for a further period of two years.

Euronext NV (EPA:ENX) has earlier today announced that it was informed that the group of Reference Shareholders, holding 23.86% of its share capital, has decided to extend an amended version of their Reference Shareholders Agreement.

This agreement dated June 21, 2017 was due to expire on June 20, 2019. It will be extended for a further period of two years commencing on June 20, 2019.

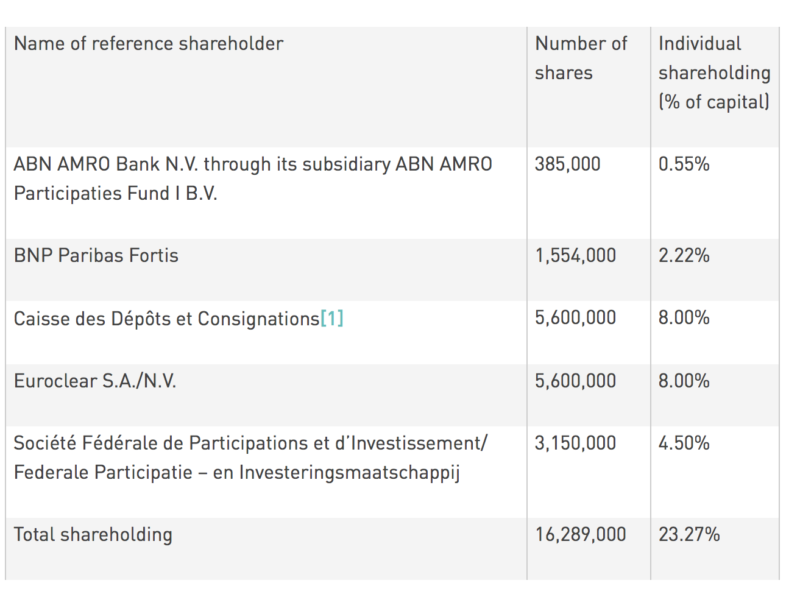

The new Reference Shareholders group will inclcude five of the existing members and account for 23.27% of Euronext share capital. The new Reference Shareholders agreed a new two-years lock-up period commencing on June 20, 2019 and expiring on June 19, 2021. The Reference Shareholders will retain their current level of representation on the Euronext Supervisory Board retaining their right to jointly nominate one third of the Supervisory Board seats.

The new group of Reference Shareholders is composed of:

On top of the renewed Reference Shareholders Agreement, the Letter Agreement dated June 13, 2017 has been amended. The revised Letter Agreement, dated June 17, 2019 stipulates the practice of regular dialogue between Euronext and its Reference Shareholders, addressing the following main topics:

- the right of the Euronext Reference Shareholders to retain one third of the Supervisory Board seats;

- the use by the Euronext Boards of the delegated authorities for the issuance / repurchase of shares, with the possible exclusion or restriction of pre-emption rights;

- the process of communication between Euronext and its Reference Shareholders, which includes periodical meetings on topics including strategy, governance and financing structure;

- the consultation of the Euronext Reference Shareholders in the selection procedures in case of any vacancies for the CEO, the COO or Supervisory Board positions.