Exclusive: Fed up with last look short shrift? Saxo takes on Tier 1 banks and disrupts best FX execution

We look in detail at how the leaders of the OTC FX industry are developing very high quality execution methodologies and exercising the non-bank relationships in order to do their bit in putting an end to last look execution to which many companies are subservient. Here is our full and detailed report as Saxo forges ahead

There are moot points, and then there are huge moot points that can no longer go unnoticed.

One of the longest standing moot points in the electronic trading business globally is the upper hand that the Tier 1 banks have with regard to two aspects, the first being their propensity toward being the only component in the entire execution system which is allowed to conduct ‘last look’ execution, and the other being their overtly dissenting attitude toward extending counterparty credit to OTC derivatives companies.

Risk and reward are viewed very differently by the world’s largest and market dominating Tier 1 FX interbank dealers, whose vast share of the order flow and margin FX trading market ebbs and flows along just one square mile of London’s Moorgate area and an even smaller piece of land at the Docklands of Canary Wharf just a short distance to the east.

To the Tier 1 banks, risk means not extending any credit to OTC participants which cannot display and maintain a balance sheet of $50 million to $100 million at all times, chopping their supply of liquidity off should this deplete even slightly, and reward means picking and choosing which trades to process on an immediate basis according to exact and current market price, and which ones with which to take a ‘last look’, meaning they can reject the trade if it does not go favorably.

This practice is commonplace among the Tier 1 dealers that the world’s entire FX market depends upon for the top-of-the-tree level of liquidity, yet if an OTC firm, or any other non-bank entity engaged in this, it would be pilloried by clients and regulators.

Whilst it is very hard to prove actual damage caused by last look, the discourse has finally reached those with a voice, and action is beginning to mount.

FinanceFeeds has researched this matter in great detail, the full report which can be read here.

In some cases, banks are now being taken to task over their last look activities, as emphasized by Alpari (US)’s case against several banks in which it is filing suit, claiming that actual damage was done to client orders as a result of banks picking and choosing which trades to process and which to not process.

The other approach is to attempt to devise new methods of providing prime brokerage and institutional order execution to OTC derivatives brokerages which circumvent the establishment and reduce the chances of being completely subservient to a last look environment at the top of the execution tree.

Saxo Bank takes action this week

Saxo Bank this week have taken exactly those steps, and is replacing the underlying feed used to trigger resting orders from its own price feed to an independent ECN price feed, that offers a combination of bank and non-bank liquidity, thus contributing to the reliant and effective functioning of the global wholesale FX market.

“With Saxo and White Label platforms that primarily facilitate market access with prudent leverage; we are truly on the side of our clients. Our main goal is to help clients succeed because we know that we succeed, when they succeed” explained a senior executieve at Saxo Bank this week.

The company will now route all Stop orders externally to be filled against ECN liquidity as a first priority. This is a safety precaution to ensure an accurate fill in line with the actual liquidity and market depth when faced with very directional client flow.

Saxo Bank’s official stance on this is that the company wants to move away from bank price feeds that are indicative last look quotes with the bank interest and internal risk appetite built in and provide a broader, more neutral and firm set of liqudity which involves bank and non-bank providers in which prices are more consistently present both in good times and in disorderly or illiquid markets.

Ensuring leadership in terms of execution and actually taking responsibility for it rather than being reliant on practices that banks employ that generate discourse is a Saxo Bank tenet, and has been discussed at length by FinanceFeeds and Saxo Bank’s senior management at the company’s Saxo Capital Markets headquarters in Canary Wharf, London.

During a recent meeting with FinanceFeeds, Saxo Bank’s Head of FX Prime Brokerage Peter Plester explained “If a client was to develop the tools required to be able to provide effective aggregated liquidity internally, there would be a lot of cost and resources and the client would spend a lot of time talking to several liquidity providers. By outsourcing that to us, we save them time and money.”

“Because clients were used to having direct relationships with liquidity providers they could have lost a lot of feedback and data but they still get it because we do it for them whereas if a broker went to a prime of prime that didn’t provide that, it may be that the broker begins to feel devoid of information” – Peter Plester, Head of FX Prime Brokerage, Saxo Bank

Mr. Plester explained that there is ambiguity among many brokerage firms about how this relationship is supposed to be structured. “We have been providing this specific prime of prime service for 4 years now” he said.

This is an example of how the astute knowledge of experts in this industry has given rise to an entire methodology that navigates the banks’ increasingly harsh stipulations.

It is absolutely relevant that banks with large FX dealing market share are allowed to continue to behave in the manner which has created the need for such innovation in the OTC markets.

Last week, FinanceFeeds approached this subject with Tim Cartledge, Head of FX and Head of Products at NEX Markets (formerly EBS Direct), who explained the company’s move toward single-ticket execution in another move aimed at mitigating the banks’ self-favoring approach to execution.

Mr Cartledge explained that this new single ticket method should also mean there is a lot less need for last look, which is a moot point among both sides of institutional trading transactions, and a matter that FinanceFeeds has dissected in great detail lately and that retail FX brokerages have started taking banks to task over.

“Clients want less rejections but liquidity providers are also under pressure from regulators and the non-banking world to reduce the amount of last look procedure that takes place” agreed Mr Cartledge.

“To help with reducing the need for last look I would like to iterate that certain aspects of poor behavior will be excluded from the platform. An example worthy of note is that there is a proprietary trading strategy in which firms are sometimes drawn toward showing wide spreads on small amounts. In reality, if you show a spread of 2 or 3 pips wide on EURUSD, when most liquidity providers in the live market are showing half a pip wide, then you’ll only be traded on when it is part of a big sweep and you would know other liquidity providers would need to hedge” said Mr Cartledge.

“This type of trading highlights that for the price of $1 million of risk, you would know that there is a larger trade that has to be covered so you would run a proprietary strategy, which is akin to front-running other liquidity providers.

“Our system puts a stop to this damaging behavior. If you were part of a trade where someone was using that strategy internalization would not work. You would be forced to reject the trade or hedge very quickly causing market impact” he said.

FinanceFeeds considers this current move by large and well organized leaders in our OTC sector of the electronic trading business toward developing methodologies that will generate a far more favorable solution for brokerages and ultimately their clients to be a very welcome one indeed.

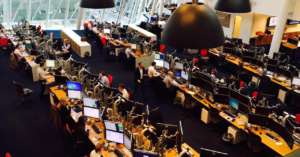

Image: Saxo Bank’s headquarters at Hellerup, Denmark. Copyright FinanceFeeds