Exclusive: Managing Director of Fortress Prime parent company Fortress Capital Investments wanted by FBI for fraud

Defunct UAE-based ‘prime brokerage’ Fortress Prime has been the subject of much media attention over the past few months in the wake of delayed withdrawals, failure to pay suppliers and partners and claims that a restructure with $200 million of new funding would occur, which never materialized. It most certainly appears that there are those […]

Defunct UAE-based ‘prime brokerage’ Fortress Prime has been the subject of much media attention over the past few months in the wake of delayed withdrawals, failure to pay suppliers and partners and claims that a restructure with $200 million of new funding would occur, which never materialized.

It most certainly appears that there are those with a propensity toward ponzi schemes, and those with a propensity toward serial ponzi schemes.

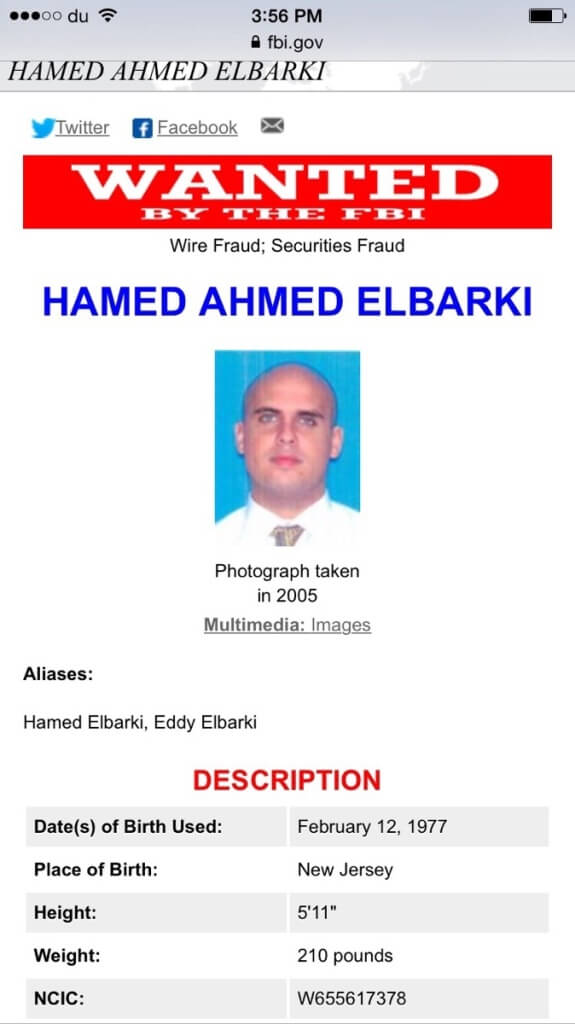

According to the US Federal Bureau of Intelligence (FBI), Hamed Ahmed El-Barki, a convicted felon, is wanted for his alleged involvement in a mortgage-related scheme that defrauded individuals out of nearly $2 million.

Mr. El Barki, who also goes by the name of Hamed Mokhtar, is a Managing Director of Fortress Capital Investments, which is the parent company behind Fortress Prime, a position that he has held since 2011 according to his LinkedIn profile.

It is alleged by the FBI that from approximately September of 2007 through March of 2008, El-Barki, doing business as Aventura Trust Investments Corporation (ATI), solicited money from two individuals who resided in South America.

The individuals believed that they were investing in the short-term purchase and sale of residential mortgage loans, promising 50% returns. Instead, Elbarki allegedly misappropriated the investors’ funds for personal use.

Mr. El-Barki positions himself as a private banker and fund manager who specializes in wealth Management, fund Management, commercial and residential real estate loan origination and funding. He also credits himself with experience in private equity as well as mutual and hedge funds.

Bizarrely, Mr. El-Barki also positions himself as an investor in the movie industry.

A point of interest is that Fortress Prime and its parent company has long since engaged in presenting itself as having substantial ownership by members of the Dubai royal family, however when viewing the website, no names are actually mentioned other than His Highness. In the Middle East, discretion is very uncommon, especially when it comes to status and therefore it is very unusual that the name of the member of the royal family is omitted from the company’s website as in the Arab world, such high standing would be a very significant draw for clients.

Mr. El-Barki’s Twitter profile, which is under the name of Hamed Mokhtar, which he uses as his professional name as Managing Director of Fortress Capital Investments, shows a clear picture of Hamed Ahmed El-Barki, as displayed here:

With the imminent demise of Fortress Prime, and Fortress Capital Investments still in operation, major clients are expecting 25p in the dollar as an initial payment along with a full repayment plan, and smaller clients holding less than $150,000 to be paid in full. This may sound familiar to those who lost in Mr. El-Barki’s home loan debacle for which he has been wanted for over ten years by the FBI.

During the last few months in which Fortress Prime has not been paying withdrawals, the company has made attempts to launch new offices in Asia.

One week after it became known that Fortress Capital Investments is to wind up Fortress Prime, Fortress Prime’s CEO Mitch Eaglstein has today announced that he has resigned from Fortress Prime having not been paid his salary for two months. FinanceFeeds understands that Mr. Eaglstein was not provided with the full extent of the matter by Fortress Capital Investments, and was constantly assured that 100% of all investments would be repaid in full on multiple deadlines.

Photographs courtesy of the Federal Bureau of Investigations, and Twitter.