FastMatch contributes €21.7m to Euronext’s revenues in 2018

Spot FX trading generated €5.5 million of revenue in Q4 2018, up 26.8% compared to Q4 2017.

Pan-European exchange Euronext has earlier today posted its key financial and operating metrics for the final quarter and full year 2018.

FastMatch reported a strong performance contributing €21.7 million to Euronext’s revenue in 2018 with a renewed management. In 2017, spot FX trading generated €7.2 million of revenue for 4.6 months of consolidation.

For the full-year 2018, spot FX trading activity on FastMatch’s spot foreign exchange market recorded average daily volumes of $20.1 billion, up 9.3% compared to 2017, on the back of markets volatility through the year.

In the final quarter of 2018, spot FX trading activity on FastMatch’s spot foreign exchange market recorded average daily volumes of $19.5 billion, up 13.7% compared to the year-ago quarter, supported by continuing markets volatility. As a result, spot FX trading generated €5.5 million of revenue in the fourth quarter of 2018, up 26.8% compared to the final quarter of 2017.

Euronext also provided an update related to the legal proceedings involving FastMatch. On February 1, 2019 a settlement was reached between FastMatch Inc, Euronext US Inc and the former CEO of FastMatch Inc. Between the parties it was agreed that $768,000 would be paid to the former CEO in settlement of claims of alleged breach by FastMatch of his employment agreement, and an amount of $8,132,000 as additional consideration for the 1,437,575 shares of common stock of FastMatch Inc that were transferred by the former CEO to Euronext US on August 10, 2018 for $.001 per share.

Let’s recall that, on August 14, 2018, Euronext announced the acquisition of approximately 8% of additional interest in FastMatch. In combination with the stake in FastMatch that Euronext acquired in August 2017, Euronext owns, since August 14, 2018, an approximate 97.3% interest in FastMatch.

The additional interest was acquired by purchasing the remaining shares owned by Dmitri Galinov, co-founding CEO of FastMatch, for $.001 per share, following his termination for cause by FastMatch. The shares were purchased pursuant to the agreement signed at the time of the acquisition of FastMatch.

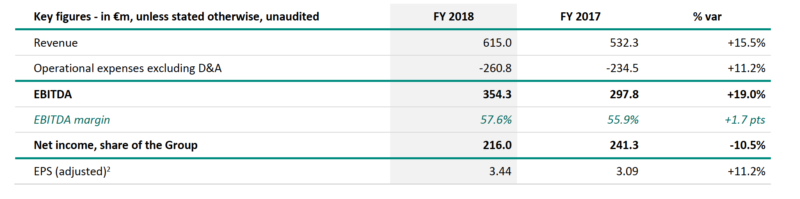

Going back to Euronext’s full-year 2018 results, let’s note that the annual net income amounted to EUR 216 million in 2018, down 10.5% from the preceding year, whereas revenues amounted to EUR 615 million, up 15.5% from the levels seen in 2017.