FastMatch contributes €5.4m to Euronext’s revenues in Q3 2018

Emerging markets volatility supported the trading activity on FastMatch’s spot foreign exchange market in the third quarter of 2018.

Pan-European exchange Euronext has earlier today posted its key financial and operating metrics for the third quarter of 2018.

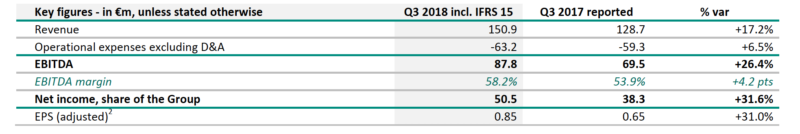

Diversification initiatives helped a 17.2% year-on-year increase in revenues in the reporting period, as they grew to €150.9 million. Euronext Dublin contributed €8.1 million, FastMatch added €5.4 million and selected growth initiatives contributed €4.4 million to the overall revenues for the quarter.

Also, Euronext reported listing revenue of €27.8 million (up 37.6% year on year), driven by the consolidation of Euronext Dublin and incremental contribution from Corporate services, and cash trading revenue at €48.5 million (up 9.2% year on year), thanks to a resilient market share, at 65.7%, effective yield management, at 0.52bps, and improved volumes. Market data and indices revenue amounted to €29.4 million in the third quarter of 2018, up 16.7% from the equivalent period a year earlier.

Trading activity on FastMatch’s spot foreign exchange market (of which Euronext owns 97% of the capital since August 2018) recorded average daily volumes of $19.4 billion, up 5.9% compared to the third quarter of 2017, supported by emerging markets volatility. As a result, spot FX trading generated €5.4 million of revenue in the third quarter of 2018. In the equivalent three-month period in 2017, spot FX trading generated €2.9 million of revenue, for 1.6 months of consolidation.

On August 14, 2018, Euronext announced the acquisition of approximately 8% of additional interest in FastMatch, a global FX spot market operator, operating as a Euronext company since August 2017. In combination with the stake in FastMatch that Euronext acquired in August 2017, Euronext owns, since August 14, 2018, an approximate 97.3% interest in FastMatch.

The additional interest was acquired by purchasing the remaining shares owned by Dmitri Galinov, co-founding CEO of FastMatch, for $.001 per share, following his termination for cause by FastMatch. The shares were purchased pursuant to the agreement signed at the time of the acquisition of FastMatch.

Kevin Wolf, US Head of FICC for Euronext and member of the FastMatch Board of Directors since September 2017, was appointed CEO of FastMatch in June 2018 by the Board of Directors of FastMatch Inc., following Galinov’s termination.