FCA analysis: No marked decline in OTC derivatives trading activity due to new EMIR margin rules

The UK regulator analysed derivatives trading data to assess the risk from firms being temporarily locked out of the market, and to monitor the extent to which that risk materialized after March 1, 2017.

The UK Financial Conduct Authority (FCA) has published an interesting analytical piece today concerning the impact of variation margin requirements set by the European Market Infrastructure Regulation (EMIR) on OTC derivatives market.

EMIR now requires firms trading certain OTC derivatives to post variation margin, which is a daily payment equal to the change in value of the contract since the previous payment. Variation margin requirements were introduced first for trades between the largest counterparties, classified as those bearing exposure to uncleared OTC derivatives exceeding EUR 3 trillion. These firms were required to start posting variation margin by February 4, 2017. On March 1, 2017, the rules became applicable to all other counterparties.

Some market participants have voiced concerns that they might be temporarily locked out of the market because they did not have the required documentation and have not implemented the procedures in time to meet the key deadline on March 1, 2017. The FCA analysis seeks to evaluate the risk for firms being temporarily locked out of the market, and to monitor the extent to which that risk did in fact materialize after March 1, 2017.

The analysis is based on EMIR trade repository data. These data are only available to regulatory authorities and provide detailed information about derivatives trades where at least one of the counterparties is a European entity.

First, the FCA examined activity levels relating to the February 4, 2017 implementation deadline. This related to the largest counterparties trading with each other, so the expectation was that these firms would be adequately prepared. The results were consistent with this expectation. Trading activity remained within normal levels around and after February 4, 2017

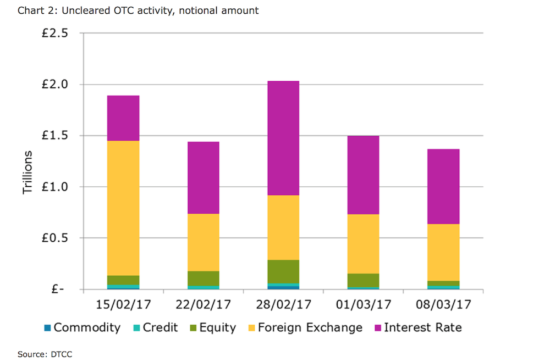

Next, the FCA examined trading data before and after the March 1, 2017 implementation date – when the rules applied to all other counterparties. The data showed a spike in trading activity in the period immediately before March 1, 2017. This is attributed to counterparties front-loading transactions ahead of the deadline to avoid dealing with the typical uncertainty stemming from the necessity to comply with the new regulatory requirements.

Overall, there does not appear to have been a material drop in activity after the implementation deadline – including in total number of trades or in notional amounts traded, the FCA analysis suggests. There has not been a significant decline in the amount of trading or the number of firms active in the market.