FCA elaborates on cryptoasset businesses’ registration

The UK Financial Conduct Authority will be the anti-money laundering and counter terrorist financing supervisor for cryptoasset businesses, effective from January 10, 2020.

The UK Financial Conduct Authority (FCA) has earlier today published a Consultation Paper outlining its proposals for fees associated with the registration of cryptoasset businesses.

Let’s recall that, the Economic Crime Plan 2019-22 (ECP) announced that the FCA will be the anti-money laundering and counter terrorist financing (AML/CTF) supervisor for cryptoasset businesses, effective from January 10, 2020. The FCA’s responsibility under the AML/CFT regime for cryptoassets business will therefore be limited to AML/CTF registration and supervision only. Under this regime, the FCA will not be regulating cryptoasset businesses for how they conduct their business with consumers.

In the Consultation Paper (CP) published today, the FCA sets out its proposals for recovering the costs of this new role as the FCA is funded entirely by fees and levies from the firms it regulates.

All UK cryptoasset businesses carrying on activities under the MLRs will need to register with the FCA from January 10, 2020. This includes all businesses already FCA registered or authorised for other activities. From January 10, 2020, the FCA will supervise and be able to take any necessary enforcement action against a cryptoasset business whether they are registered with the FCA or not.

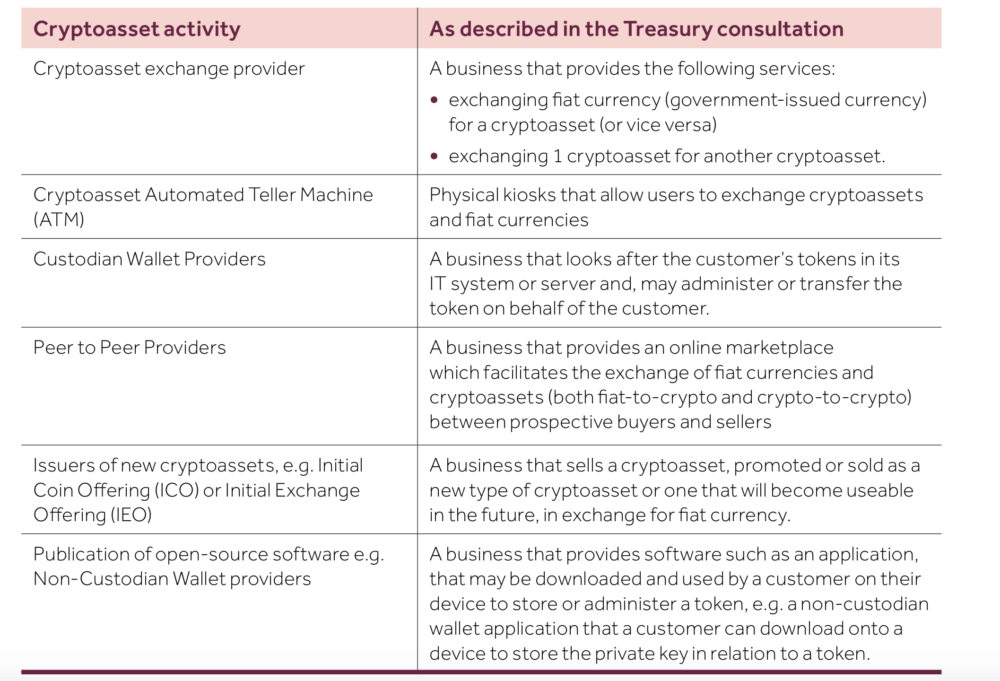

Cryptoasset businesses carrying out the activities listed below should assume they must comply with the MLRs from January 10, 2020:

In particular:

- A new business that intends to carry on cryptoasset activities after January 10, 2020, must obtain FCA registration before it starts that business, in addition to other permissions it may require, particularly if the business is using security tokens or e-money tokens.

- An existing business, that has been carrying on cryptoasset activities before January 10, 2020, must be registered by 10 January 2021 or stop that activity. An existing business that has received a decision from the FCA to refuse registration before January 10, 2021, must also stop its cryptoasset activity.

The FCA will recover its costs from cryptoasset businesses through:

- one-off registration fee;

- a periodic (annual) fee.

As cryptoasset activities will be new activities under the MLRs, the FCA has limited information on the different business types and the relative complexity involved in assessing them. The regulator therefore proposes to distribute recovery of the costs of setting up and operating the registration process equally between all applicants. The FCA estimates the total cost of this process at approximately £400,000 and it is aware of about 80 potential applicants.

The FCA accordingly proposes to set the registration fee at £5,000. This fee will also be paid by businesses that are already authorised or registered with the FCA and which must register with the FCA to carry on cryptoasset activity.

The response date for the question regarding the proposed registration fee is 11 November 2019.

The key features of the FCA’s proposals on periodic fees for cryptoasset businesses are:

- Fee block: the regulator is proposing to create a new fee-block for cryptoasset businesses.

- Tariff base: Following initial discussions with a range of cryptoasset businesses, the FCA believes its standard definition of income would apply and that this would be the most appropriate method of distributing cost recovery.

- Reporting date: the FCA asks fee-payers to report on the basis of their accounts, for their financial year ending during the previous calendar year. This means that the 2020/21 fees would be based on their accounts for their financial year ending up to 31 December 2019.

- Thresholds and minimum fees: The FCA sets minimum fees in many fee-blocks. Up to a certain amount of income, fee-payers pay a fixed minimum fee plus a variable fee on any income above the threshold. Several fee-blocks have a minimum fee of around £1,000 on income up to £100,000. The FCA would welcome comments on the appropriate minimum fee and minimum fee threshold for cryptoasset businesses.

The response date for the question regarding the periodic fees is 10 December 2019.