FCA marks slight rise in unanswered calls from consumers in 2018/19

The UK regulator has reduced the number of unanswered calls from firms from 2% to 1.8% but unanswered calls from consumers increased from 1.6% to 2%.

The UK Financial Conduct Authority (FCA) has published its Service standards report for 2018/19. The publication provides information about the FCA’s performance in a range of areas, both statutory standards (as set by The Financial Services and Markets Act 2000 (FSMA) and other legislation) and voluntary commitments. It covers 60 service standards on activities including dealing with regulatory applications, telephone enquiries, and other correspondence.

The FCA’s Customer Contact Centre is the first point of interaction with firms and consumers, so it is important that the regulator is available to provide online and telephone help when it is needed.

The FCA has provided a substantive response to firm’s email/web form/webchat correspondence within 2 working days 93.1% of the time and letter within 5 working days 91.9% of the time. These are above the FCA’s voluntary target of 90%. However, they have both reduced when compared to 2018.

The regulator provided a substantive response to correspondence received from consumers email/web form/webchat within 2 working days and letters within 5 working days. Both are above FCA’s voluntary target of 90%.

The regulator also monitors the performance of its telephone service by the number of calls that are ended before they are answered. This happens if no advisers are available to answer a call promptly or the caller decides to end the call rather than wait. The FC A seeks to minimise the number of unanswered calls by predicting when the contact centre will be busiest and making staff available.

The regulator aims for unanswered telephone calls directly to the Contact Centre to be no more than 5% (voluntary target) for both firms (CM2.3) and consumers (CM3.1). The FCA has achieved this target this year for both firms and consumers and has reduced the number of unanswered calls from firms from 2% to 1.8% but unanswered calls from consumers increased from 1.6% to 2%.

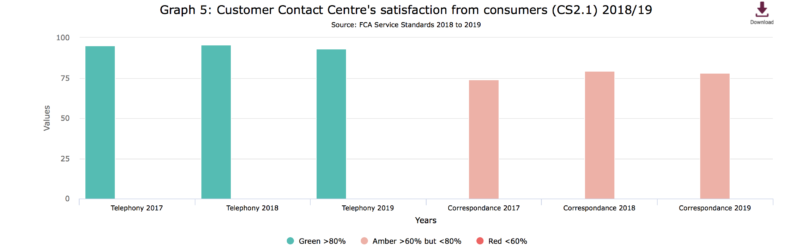

The FCA offers customers a post-call survey to measure its Customer Contact Centre’s performance. The regulator has set a voluntary target of 80% satisfaction for both telephony and correspondence. The regulator has separated the standards for consumers (CS2.1) and firms (CS2.2).

The correspondence satisfaction scores have improved following the FCA’s work to ensure that its written communications are free of jargon and easy to understand. Its webchat channel is liked and consistently scored highly by consumers. In the future, the FCA aims to increase the availability of webchat and to promote its use.

Finally, the FCA assesses its response to MPs letters. The FCA is an independent financial regulator, accountable to the Treasury and Parliament. Every year it reports to the Treasury on its progress through its Annual Report. The Treasury then submits a report to Parliament on the FCA’s performance against its statutory objectives and how it has dealt with major regulatory cases.

As part of the FCA’s accountability to Parliament, the FCA responds to requests for information from MPs and peers through letters, parliamentary questions and evidence to All Party Parliamentary groups. As a public authority accountable to Parliament, it is important that the FCA responds professionally to such letters so the FCA sets itself target Service Level Agreements (SLA) for responding.

The FCA’s SLAs are paused if the regulator has to seek more information externally, for example from a constituency office, a firm or to another organisation. So, the period it takes the FCA to respond can be longer than the reported SLA.

The FCA has set a voluntary target of 80% (CM5.1a) to provide a substantive reply to letters from MPs within 15 working days and a voluntary target of 100% (CM5.1b) to respond within 20 days. In 2018/19, the FCA dealt with 405 letters (220 of which were replied to within the SLA) from Parliamentarians on behalf of their constituents this year compared to 294 last year. The FCA is taking steps to address the delays caused by increased volumes and expects to see improvements over the next year.