Fed Hawks in Jackson Hole

Fed Hawks in Jackson Hole – USD/JPY shot past 102 on Yellen’s and Fischer’s hawkish comments.

By Wayne Ko, Head of Research & Education at Fullerton Markets

“Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.” said Fed Chair Yellen in her speech during Jackson Hole Symposium last Friday. Vice Chair Fischer further supported her comments, saying a rate hike in September and 2 rate hikes this year are possible. The dollar rallied to a 2-week high against most of the major currencies. The comments have pushed the odds of a rate hike in December to more than 60%. If the upcoming Non-farm Payroll adds around 190K or more jobs, it could well push the odds even higher, together with the dollar.

The delay in Fed rate hike is posing a challenge to other central banks trying to boost their inflation or fight disinflation. The most recent examples are RBA, RBNZ and BOJ. All 3 central banks wanted to weaken their currencies by slashing interest rates to historical low or announcing more stimuli. Their currencies remained relatively strong due to the weakness in US dollar. Fed hawks came in the right time to support the dollar. We maintain our bias of an unlikely rate hike in September, ahead of the US presidential election in November. The likelihood of a rate hike would be in December.

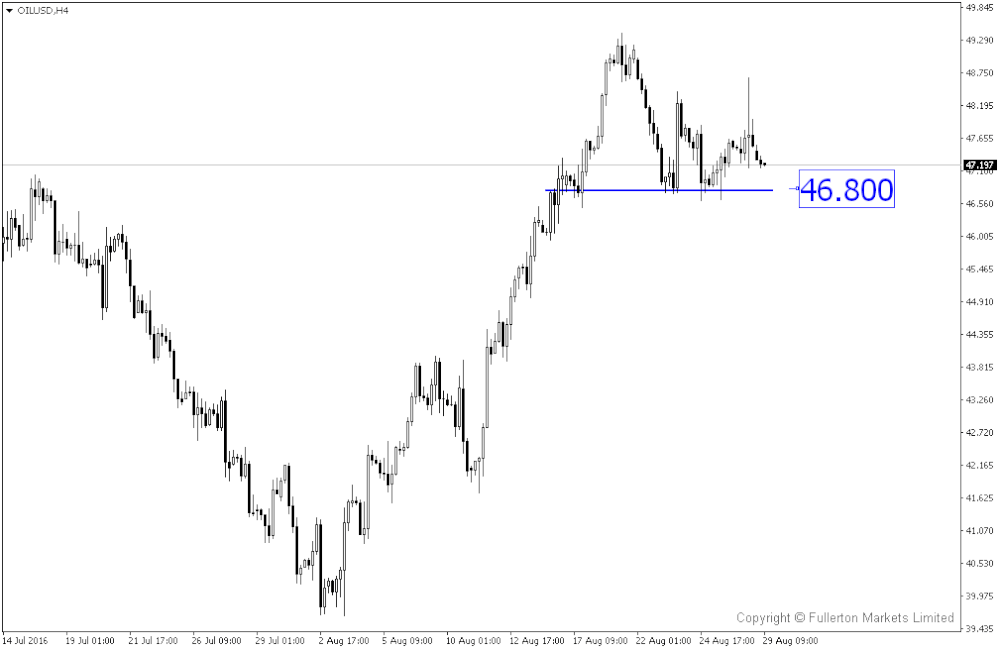

The other factor contributing to the low inflation is the relatively low oil prices. WTI has risen recently on speculation of possible production freeze deal … again. But, speculations can do just this much. WTI now hovers between $47 and $48 per barrel, awaiting more concrete progress in the proposal. If there is no progress in the next one month, prices may head south again.

Without a doubt, the Non-farm Payroll will be the most watched data this week. Besides that, UK Manufacturing PMI and Construction PMI could give further clues to the impact after Brexit referendum. The previous figures of 48.2, 45.9 and 47.4 have shown contractions in all 3 sectors, manufacturing, construction and services respectively. Judging from the other relatively positive UK data, we do expect the upcoming PMIs to show a lesser margin of contraction as compared to the previous figures.

Our Picks

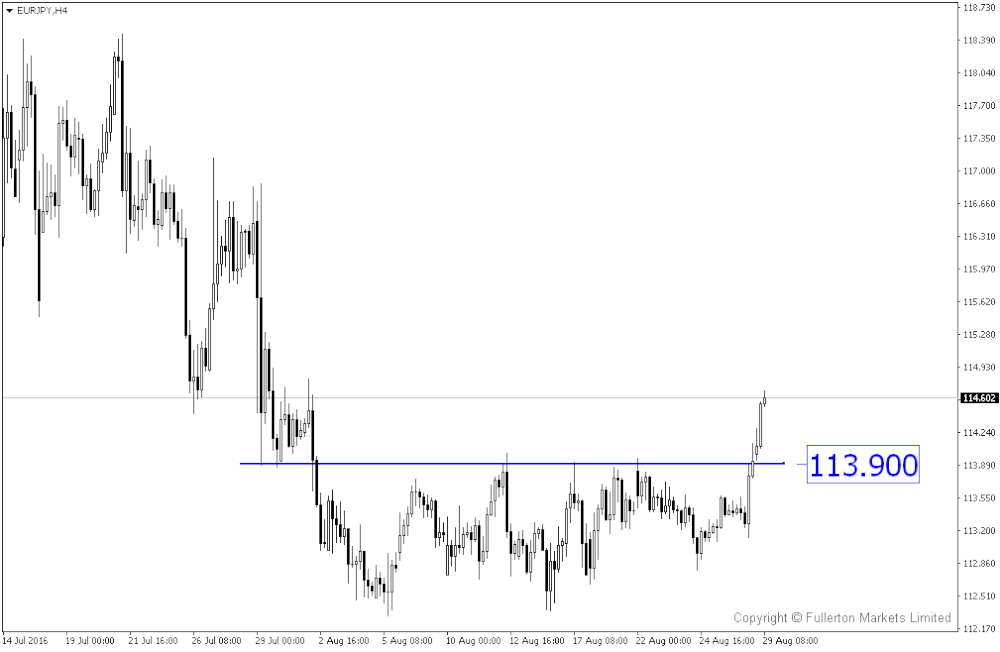

EUR/JPY – Slightly bullish. Price has broken the resistance around 113.90. The bullish momentum may continue. Possible to buy at dips.

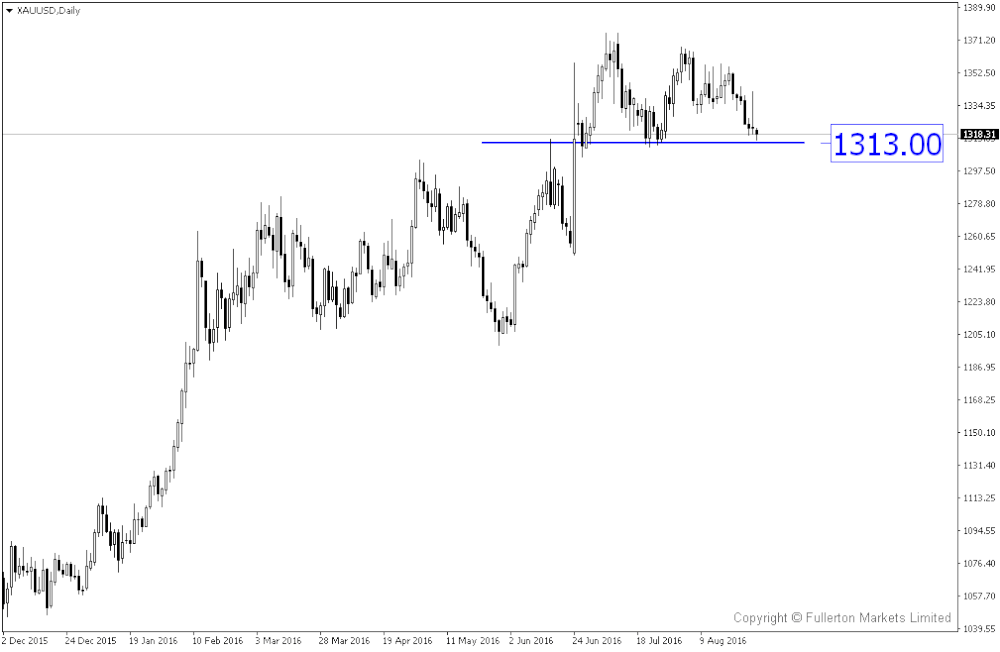

XAU/USD (Gold) – Slightly bearish. Gold is dropping as dollar strengthens. Price is near support of 1313. Favourable Non-farm Payroll may be the catalyst for it to break the support.

OIL/USD (WTI Oil) – Slightly bearish. WTI is consolidating between $47 and $48. Near term dollar strengthen may push it towards $46.80.

Top News This Week (GMT+8 time zone)

Australia: Retail Sales m/m. Thursday 1st September, 9.30am. We expect figures to come in at 0.4% (previous figure was 0.1%).

UK: Manufacturing PMI. Thursday 1st September, 4.30pm. We expect figures to come in at 49.3 (previous figure was 48.2).

US: Non-farm Payroll. Friday 2nd September, 8.30pm. We expect figures to come in at 192K (previous figure was 255K).