FIA publishes report on growth and future of listed derivatives

The research incorporated viewpoints from 210 individuals, including professionals from clearing firms, brokers, asset managers, hedge funds, exchanges, and other market infrastructure operators, with a balanced geographic representation from North America, Europe, and Asia-Pacific.

The Futures Industry Association (FIA) has released a comprehensive report on the derivatives industry, shedding light on the prevalent challenges and emerging trends that are shaping the future of global listed and cleared derivatives markets.

Crafted by Coalition Greenwich, the paper titled “Derivatives Market Structure 2024: Focusing on Capital and Workflow Efficiency,” draws from the insights of over 200 professionals across the derivatives sector, including those from brokerage, clearing, asset management, hedge fund, exchange, and technology firms.

Conducted between November and December 2023, the study emphasizes a widespread call for enhanced capital and operational efficiencies within the industry. Respondents unanimously pointed to the stringent capital requirements as the foremost hurdle, highlighting the critical need for optimizing margin and collateral management. Operational challenges, particularly in regulatory reporting, allocations, and give-ups, were identified as significant obstacles needing immediate attention. Innovations like standardization and tokenization in collateral management are seen as pivotal developments capable of revolutionizing trading and clearing workflows.

The potential growth avenues for derivatives trading

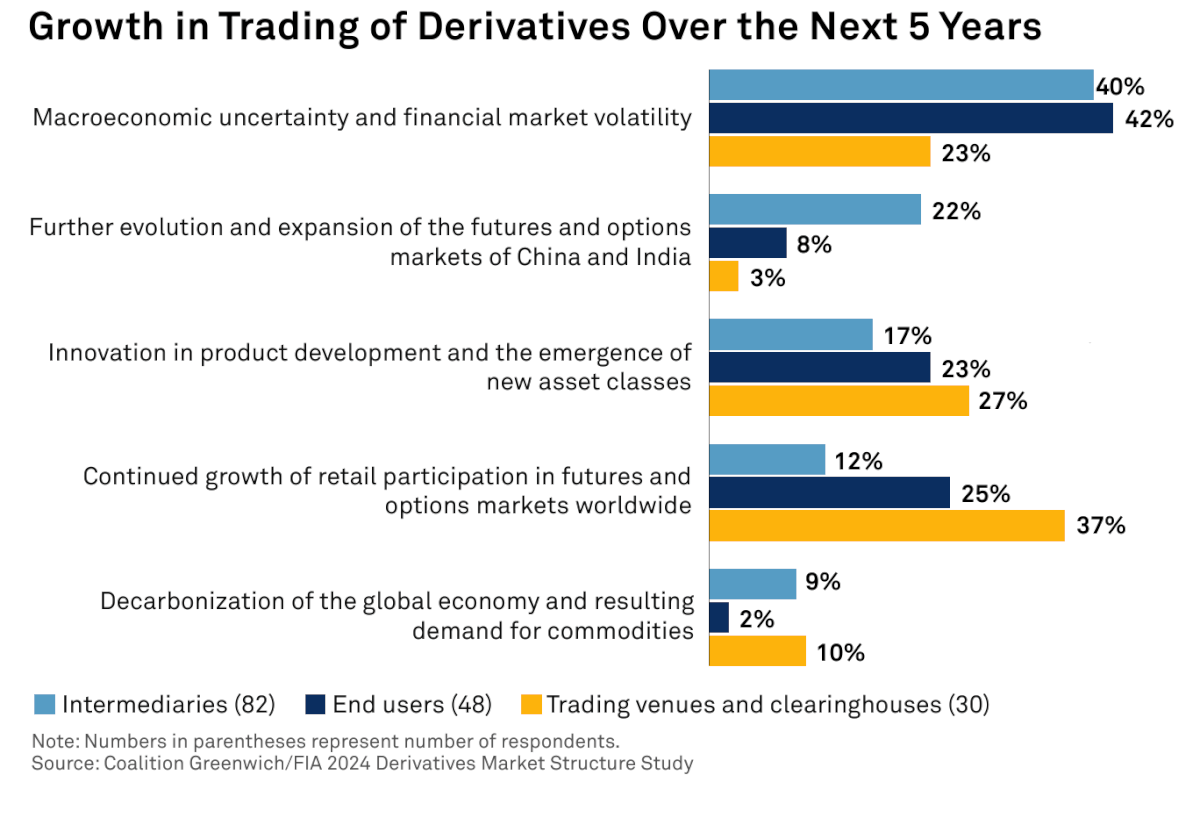

The report also explores potential growth avenues for derivatives trading, underlining macroeconomic uncertainties, and market volatility as the primary catalysts expected to drive trading volumes over the next five years. Interestingly, perspectives on other growth drivers varied among industry participants. While intermediaries foresee significant opportunities in the burgeoning futures and options markets of China and India, exchanges and end-users anticipate substantial growth from the increasing retail participation.

The Future of the derivatives trading industry

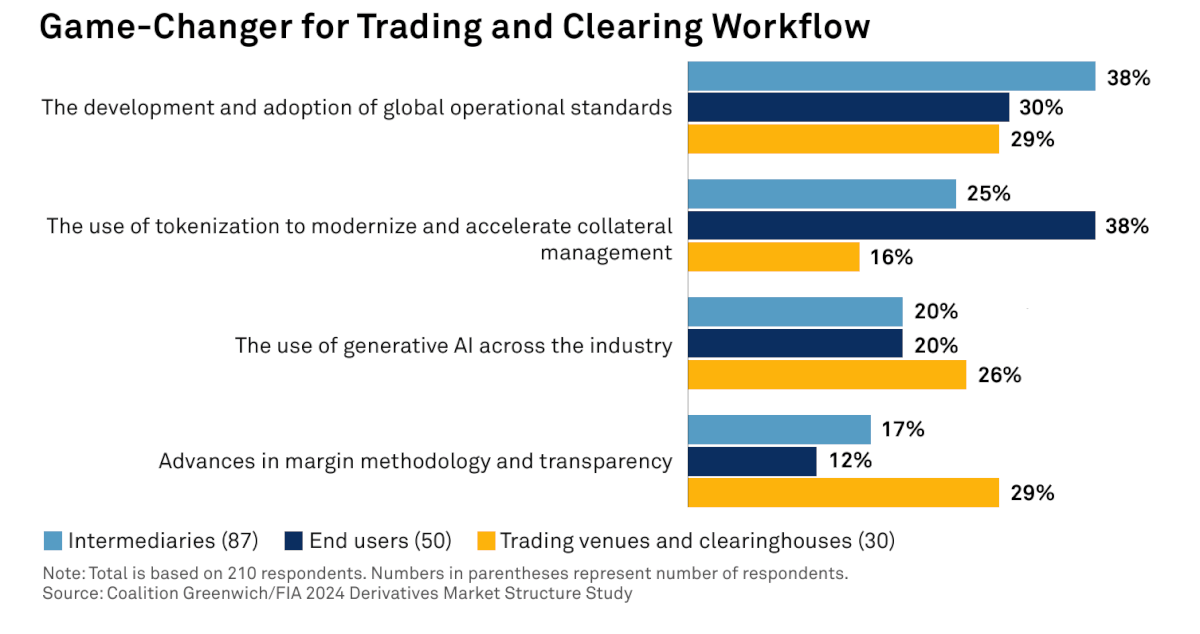

As to the future, the report noted that while AI and machine learning (ML) are exciting, the real game-changers are often much simpler. “For intermediaries, the biggest game-changer would be the development and adoption of operational standards at the global level. That reflects their central role between end users and markets, and the many challenges they face in processing trades and moving collateral through a highly complex network of technology and data systems.

“For end users, tokenization ranked as the biggest potential game-changer for the trading and clearing workflow. Tokenization is still at a very early stage of development, but many large asset managers are working on projects to test the potential for using this technology to move cash and securities more efficiently.

“From their perspective, the transformation of financial assets into tokens and the use of distributed ledgers to manage transfers could lead to a substantial reduction in time and expense. For market infrastructure operators, margin methodology and transparency ranked relatively high as gamechangers. This may reflect the transition from SPAN- to VaR-based margin models now underway at several major clearinghouses, as well as an industry-wide effort to build better systems for forecasting margin requirements.

This analysis was released alongside the FIA’s International Futures Industry Conference in Boca Raton, Florida, an event that gathers over 1,200 industry leaders from more than 20 countries to discuss the dynamics of the global derivatives market.

The research incorporated viewpoints from 210 individuals, including professionals from clearing firms, brokers, asset managers, hedge funds, exchanges, and other market infrastructure operators, with a balanced geographic representation from North America, Europe, and Asia-Pacific. This diverse pool of respondents provided a rich, comprehensive understanding of the challenges, strategic priorities, and regulatory responses shaping the derivatives market today.