First Derivatives continues search for new CEO

“We continue to progress our search for a new CEO following the passing in July of our founder, Brian Conlon”, says Seamus Keating, Executive Chairman of FD.

Fintech company First Derivatives plc (LON:FDP) is continuing its search for a successor of FD’s founder and CEO Brian Conlon who passed away in July this year.

Today, First Derivatives said that, under its succession planning, a process to appoint a successor was initiated and Non-Executive Chairman Seamus Keating was appointed Executive Chairman to guide the business through that process and oversee the Executive Committee in the interim period. The CEO recruitment process is a priority for the Group and a further update is set to be provided in due course.

Seamus Keating, Executive Chairman of FD, said:

“We continue to progress our search for a new CEO following the passing in July of our founder, Brian Conlon, and we will provide an update when the process is complete”.

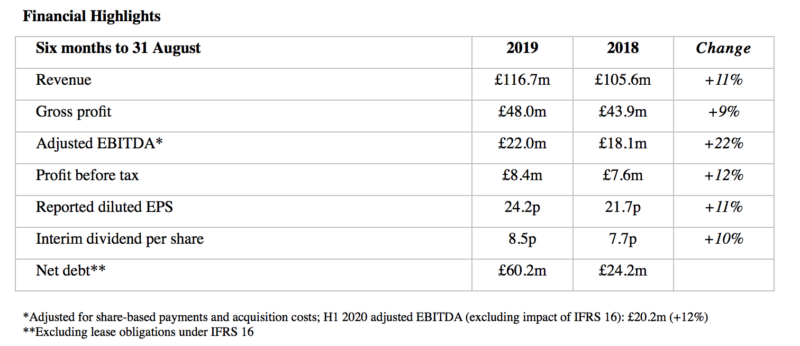

Also today, First Derivatives posted its results for the six months to end-August 2019.

Software revenue in the period grew 13% from a year earlier to £71.4 million, supported by 19% growth in recurring software license revenue.

The company noted multiple contract wins across both software and managed services and consulting, including notable deals signed with a major Japanese bank for the global roll-out of a next generation e-FX platform built on Kx and multi-year assignments across FD’s managed services and consulting business.

Software revenue from Industry increased by 45% from thee equivalent period a year earlier to £4.4 million.

Managed services and consulting revenue is 7% higher than a year ago at £45.2 million, with long-term, strategic client relationships and market-leading services enabling continued growth.

Seamus Keating commented: “We successfully executed on our strategy during the period, signing a number of key contracts across our business, and making strong progress towards securing landmark contracts in the markets we are targeting across Industry. Our financial performance was solid, and we are encouraged by the growing momentum through the period that provides confidence in achieving another year of strong growth, in line with consensus forecasts.”

The Group believes consensus revenue and adjusted EBITDA (excluding the impact of IFRS 16) forecasts for the year to 29 February 2020 to be £242.9m and £43.8m respectively.