FIS marks 50% Y/Y rise in revenues in Q1 2020

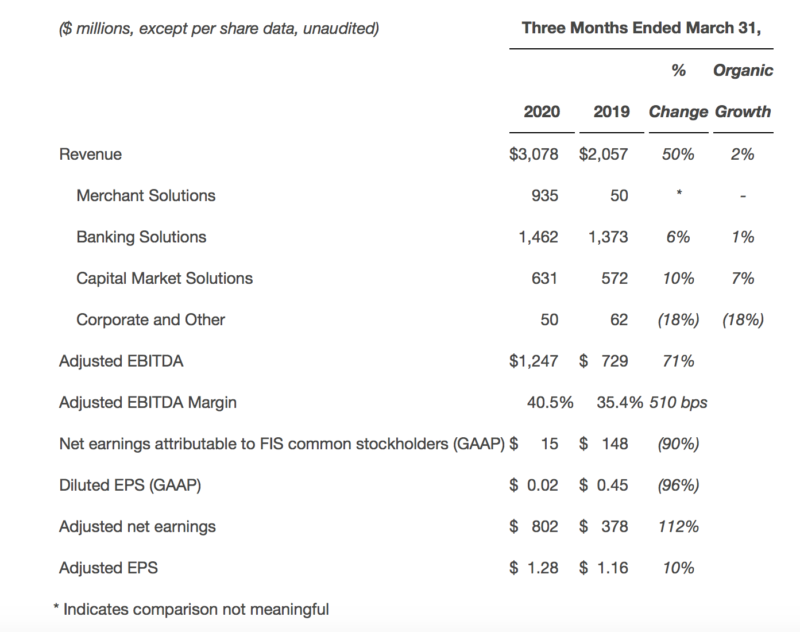

Revenue increased 50% to $3,078 million, primarily driven by the acquisition of Worldpay.

Financial services technology provider FIS (NYSE:FIS) today reported its financial results for the first quarter of 2020, with revenues up sharply thanks to the positive impact of the Worldpay deal, whereas net earnings fell.

On a GAAP basis, revenue increased 50% to $3,078 million, primarily driven by the July 31, 2019 acquisition of Worldpay.

On an adjusted basis, organic revenue growth increased 2% over the prior year period. Adjusted EBITDA margin expanded by 510 basis points (bps) over the prior year period to 40.5%, primarily driven by the acquisition of Worldpay and associated expense synergies. Adjusted net earnings was $802 million or $1.28 per diluted share.

Net earnings attributable to common stockholders was $15 million or $0.02 per diluted share.

The Merchant Solutions segment saw first quarter revenue increase significantly to $935 million, primarily reflecting the Worldpay acquisition, and excluding $10 million which was reclassified to the Corporate and Other segment. Organic revenue growth was flat compared to the prior year period, primarily attributable to declines in payment processing volumes associated with the ongoing COVID-19 pandemic. Adjusted EBITDA margin was 45.2%.

The Banking Solutions segment marked a 6% year-on-year rise in revenues to $1,462 million, excluding $40 million which was reclassified to the Corporate and Other segment. Organic revenue growth was 1% over the prior year period, including approximately 2 percentage points of negative impact created by non-recurring revenue realized in the prior year period as well as declines in issuer processing, debit network and account transaction volumes associated with the ongoing COVID-19 pandemic. Adjusted EBITDA margin was 42.0%.

The Capital Market Solutions segment registered revenue of $631 million in the first quarter of 2020, up 10% from a year earlier. Organic revenue growth was 7% over the prior year period. Adjusted EBITDA margin was 44.4%.

As the company continues to execute on its integration workflows and optimize its portfolio of assets, certain non-strategic businesses were reclassified from Merchant Solutions and Banking Solutions into the Corporate and Other segment. These operations represent less than 2% of first quarter 2020 revenue. This segment saw first-quarter revenue decrease 18% to $50 million. Adjusted EBITDA loss was $70 million, including $81 million of corporate expenses.

FIS continued to realize revenue and expense synergies during the first quarter of 2020. The company achieved annual run-rate synergies exiting the first quarter 2020 as follows:

- Revenue synergies of approximately $100 million, an increase of $20 million compared to the fourth quarter of 2019;

- Expense synergies of approximately $580 million, inclusive of approximately $275 million in interest expense savings, an increase of $115 million compared to the fourth quarter of 2019.

As a result, FIS reiterated its previously-announced revenue synergy targets and increased its expense synergy target as follows:

Revenue synergy targets on an annual run-rate basis:

- $200 million exiting 2020;

- $550 million exiting 2022.

Expense synergy target on an annual run-rate basis:

- At least $700 million exiting 2020, inclusive of approximately $275 million in interest expense savings, an increase of more than $100 million as compared to the fourth quarter of 2019.