Flipping the EA model on its head. Major technology provider rides the platform revolution wave

FinanceFeeds met with R&D engineers and project leaders to look at a new brokerage optimization software which forms an integral part of a complete enterprise solution, taking customer retention, acquisition and database usage to a different methodology, superseding even the ubiquitous EA model

A very well worn and much discussed matter of importance within retail brokerages is not just the continued need to rejuvenate revenue streams and ensure best use of customer databases, but the method by which this can be done effectively, usually relating to the refinement of lead conversion, the ability to engage existing customers, and subsequently to retain them.

Traditionally, ever since the introduction of the soon to be obsolete MetaTrader 4 platform which gave rise to a vast number of small brokers and white label partners that established retail trading firms very quickly and with a marketing-led ethos rather than an institutional and proprietary technology perspective, customer acquisition and retention have been the two tenets of survival.

Some thirteen years since the introduction of MetaTrader 4 and its monopolistic grasp on the retail FX sector, 1231 MetaTrader 4 entities currently exist, which has given rise to another very important matter, that being the value proposition conundrum.

Having invested nothing in the development of their own systems and relied on a third party system that accounts for over 85% of the external retail FX platform market worldwide, many firms that have operated until now on a completely outsourced, off the shelf infrastructure basis have faced great difficulty in differentiating their product and service range from the swathes of other brokers and white label partners, and thus ensuring that their customers stay and generate revenue when the sole bargaining point is a tiny difference in spread or commission.

Nowadays, with regulatory and administrative costs at an all time high, firms that did not enter the market with any comprehension that they would be faced with the same adherence as the highly established and self-sufficient retail FX giants of New York and London are now feeling a significant squeeze.

Today, FinanceFeeds took a close look at a new technology for brokerages which has been launched by Leverate, its rationale being to introduce a user experience-led method of attacking the issue of conersion and retention, and also the churn rate of retail customers.

At the company’s head office, FinanceFeeds met with Yuval Kalev, a lead software developer for the company’s Activ8 system, who demonstrated its functionality.

Indeed, Activ8 was initially launched in the last quarter of 2016, however a substantial amount of upgrading and refinement has been conducted since then.

Mr Kalev explained that the introduction of the Activ8 system came about due to the need to approach the issue of conversion, engagement and retention, and that Leverate considered the best means of doing so to be via user experience (UX).

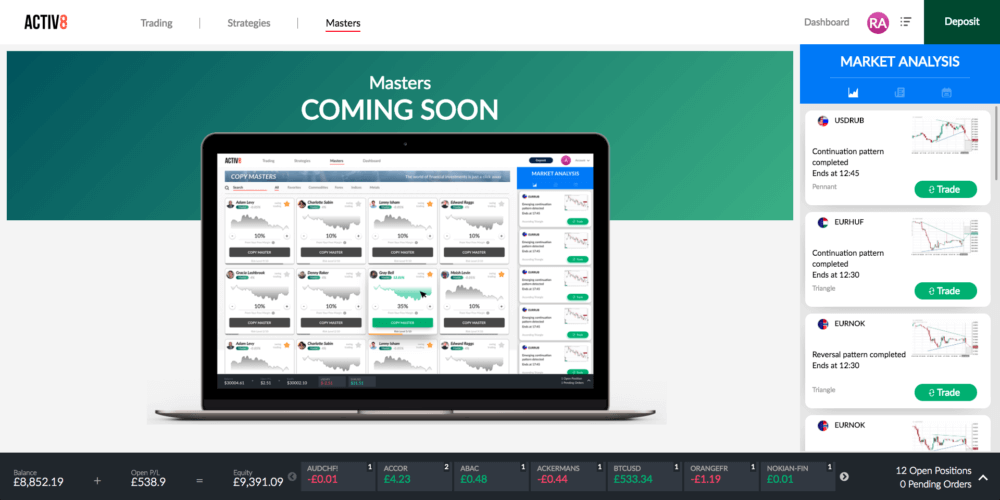

“Activ8 is divided to a few pillars, those being trading, strategies, which involve copying bundles of EAs with certain common interests, and masters which are real people which traders can have confidence in and would want to copy” said Mr Kalev.

“This area demonstrated here is the Explore page which summarizes various instruments, strategies and masters. Once a strategy is copied, can choose percentage of trading balance to copy strategy” he said.

Explaining the functionality further, Mr Kalev said “There is a section on the right hand side which contains third party content on market analysis and technical analysis. This is proided by Autochartist which is a very powerful system. We had a competition inside Leverate in order to prove the concept and used tech analysis from Autochartist which worked very well indeed” he said/

“This is prioritized on the menu as it gives the best added value to brokerages. There are call to action buttons in prominent places across each analysis, therefore for each tech analysis that is selected, a user can click the trade and get to the instrument, making it very easy to execute the trade. Users can add stop loss or take profit settngs directly from the chart itself. It is a much better user experience than that provided by legacy systems” said Mr Kalev.

“For the news and economic calendar, we have integrated a solution provided by MTE Media, therefore users can see the news with impact” he explained.

The negative connotations associated with social trading – no more unaccredited ‘leaders’

Social trading and copy trading solutions have been the subject of criticism by FinanceFeeds over the years, and this is a perspective that we stand by to this day, and has been ratified by the defunct nature of almost every single provider of social trading, as well as social trading platforms offered by brokers on a proprietary system.

FinanceFeeds views the entire concept of social trading and copy trading to represent a conflict of interest between brokerage, customer and social trading software provider.

Social trading may well have been written off as a fad, a triumph of marketing over substance which generated volume-based commissions for its developers, and which led many retail FX brokers to consider it a tool to increase the confidence of novice traders, whilst paying the social trading provider a pip per transaction in order to generate greater return on investment by extending client lifetime value.

To no surprise whatsoever, social trading is largely a thing of the past.

Three important commonalities that describe today’s retail traders are self-empowerment, enlightenment and understanding, and the basis of the demands placed upon retail FX brokerages in the major and well respected jurisdictions of North America, Britain, the Far East and Australia these days revolve around requirements from direct retail traders, not, as was once the case, the dictation of services by the broker to the client.

oday, it is a science which a large proportion of retail traders understand clearly, and, as has been noticed by FinanceFeeds for quite some time, this has led to the passing of the social trading era, which was once a no more an engagement tool to bolster the confidence of novices.

A placebo, in which unaccredited ‘lead traders’ were producing volume for a broker whilst it was not their profession, and in an electronic case of the blind leading the blind, novice traders would feel some degree of comfort as their accounts automatically executed trades following the actions of an equally inexperienced retail customer of an often b-book brokerage.

Examples of the haplessness that began the fate of social trading include OANDA Corporation’s failed attempt at taking its fxUnity product to a wide audience over five years ago. The company is a technological tour de force, yet it brought ruinous R&D costs into the boardroom when it canned the fxUnity proprietary social trading platform a very short time after launch, before then becoming embroiled in the catastrophic purchase of the Currensee social trading network which was wound down and discontinued very soon after its acquisition.

Compare that to the self-directed traders that favor proprietary platforms and are experienced in navigating the markets electronically, and OANDA’s migration of 2,200 Tradestation users onto OANDA’s fxTrade platform last year when IBFX exited the US market demonstrates that the same company could not engage traders on social platforms, but was absolutely able to benefit from the onboarding of astute, self-empowered traders who favor a high quality brokerage environment and proprietary platform.

Since then, pretty much every single social trading platform has shuffled off the cyber coil.

ZuluTrade, one of the original entrants into the social trading arena, was fined by the National Futures Association (NFA) in the United States, just at the time that the future was looking bleak for such services, leading to a very important matter which other regulators that preside over good quality jurisdictions took note of – that this constitutes financial advice, and indeed financial advice provided by private individuals with no license and no responsibility to ensure the customer’s best interests.

Very much aware of the need to provide good quality leadership and direction to less experienced traders in order to increase volumes, Leverate has developed a method of ensuring that greater volumes are achieved by automatically retaining a client base, that being one of the greatest attractions for brokers toward social trading in its heyday, but have removed the conflict of interest significantly by ensuring that the lead traders are accredited and that the method by which the platform operates is able to encourage traders to remain with a brokerage for a long term, rather than either burning their deposit and never trading again, or being led down a similar path by following an equally novice trader and then being charged for it on spread, whilst the trade ‘leader’ takes an IB commission.

“As far as anyone who sets themsevles up as a master is concerned, you know you are copying someone who is selling you a strategy. Our leaders are regulated and licensed asset managers. Using a bundle that is specifically tailored toward strategies that each asset menager wants to promote, and it is followable and you can see all aspects of it” explained Mr Kalev.

“Any given moment in time, when you see the dashboard, you have full visibility into performance. Its not like the old copy trading which was untransparent” he said.

“On the Master side, Leverate never had an incentive scheme for masters, so therefore it is a pure network of experienced traders. All of it is managed by a portfolio manager at Leverate Financial Services, who carries a MiFID II compliant asset manager license and is administering the entire system from an isolated office, in Cyprus, hence cannot distribute the information to other sources” said Mr Kalev.

The banks adopted a method of isolating their traders during the probes into FX benchmark rigging during the earlier and middle part of this decade, in order that they would not attempt to boost their own commissions at customer expense by exchanging important information between themselves.

“The main issue is trust” said Mr Kalev. One of the aspects in this is to create a good quality and transparent comfort zone for the trader, in which the tader can see a better view of what is going on with the account. One aspect is the portfolio, the other is the dashboard. Our dashboard gives a real time comprehensive status of the status of the customer account.

On this section, users can monitor success rate, average P&L, and can gain a granular understanding of trading performance, as well as how the risk meaurements are calculated.

This is displayed as best and worst positions in P&L, the total amount allocated to each master or strategy, and periodic percentages of P&L over the past year, six months, three months or one month, average trade size, number of weeks active as a trader, number of weeks with an overall profit since commencing, average number of daily positions, total trades made, number of profitable copiers and losing copiers, total profit or loss from all closed posiitons in absolute terms, and success rate.

Mr Kalev explained “Granular data on all aspscts of performance and trading are included, as this provides more trust. If we see something inappropriate among strategists that we work with, we then make sure not to put strategies that are too dangerous on the system. People that write the strategy give us full info about it, and we ask important qualifying questions.”

“Each strategist must be onboarded and approved properly and according to regulations. They fill in a form, then a licensed Leverate official assesses it and puts it in the pool. Once that has been done, the portfolio manager of each broker can see which strategy should be used” – Yuval Kalev, Software Developer, Activ8, Leverate

Mr Kalev continued “Each trader can see strategies in the system. It then has comprehensive information to help him make informed decisions. Strategy providers can practice their own strategies in a ‘sandbox’ environment to ensure compatibility with the system. Currently, we are conducting a refinement so that the brokers can understand the strategies correctly.”

“There is a call to action that it shows used margin and free margin on a real time basis, to encourage traders to use the ‘free margin’ amount, which performs as a very effective retention and engagement tool” he said.

“For example, some brokers want to see cryptocurrency, whereas some brokerages are commodities and equity based and have different risk levels. For example the Big Tech strategy listed here follows Google, Amazon and Facebook” he said.

“This entire system flips the EA model on its head. If you were an EA user, you would have to have a desktop installation, have to find a plug-in and then install it on your desktop, and would be reliant on peer to peer EAs which is now an obsolete method. In this case, brokers can make these strategies available directly with no reliance on unsupported peer to peer software” – Yuval Kalev, Software Developer, Activ8, Leverate

“With regard to market sentiment, it is important that everyone using the system can see what people are buying or selling, hence we have a difference in sentiment. This is part of Activ8 in the form of our Multi-demensional sentiment indicator, which gives the trader the feeling of the market. We do this by analyzing the time frame of positions and volume in the system on a real time basis” he explained, “therefore it is part of the element of creating more engagement in the system, to make good trading decisions.”

When looking at how some active optimization tools that have not attracted the market share that they could have done, We looked at how learning from this had been a development ground for Activ8.

FinanceFeeds brought up Tradency’s RoboX, which was launched almost two years ago and has gained some traction yet has not driven the firm’s revenues onward.

“RoboX failed because you can’t push people do do things they don’t want to do. Technology is an enabler, and it should be a win win for the trader and broker” said Mr Kalev. “Consumers want to make their own decisions and not to be sold to directly. An old marketing model involves looking at client behavior and then just before they are about to quit, to push them into something else. This goes against the interests and buying behavior of consumers” he said.

Thus, Leverate’s ethos with regard to education is to provide good and licensed streategies that are sustainable and therefore useful to brokers.

“I saw two sides of the spectrum” explained Mr Kalev. “On one side was Tradency with loads of data and strategies, and most had names that traders don’t feel attached to, with pseudonyms and no credibility, and incorporating a vast amount of data. On the other hand I see eToro, and they give very good names to their copy funds like Warren Buffett Portfolio, which is a basket of all the companies that Warren Buffett invested in along the way like Coca Cola and American Express. It is then sold by the basket but it is great. We wanted to do something hybrid, therefore give it a good UX and UI, great packaging and ergonomics, and on the other hand still be loyal to technical analysis and indicators. We combined the two to create packaging and something that works on technical analysis and create volume” he said.

In terms of other development matters that had to be addressed when looking at historical systems, trading terms of the strategy were not similar to the terms that the trader had in many cases, and when you have scalping strategies, this is very important.

“You can see 10 positions that have positive P&L yet all those following them have negative P&L, for example” said Mr Kalev.

Concluding, Mr Kalev stated that in today’s world in which the necessity to retain a proper and clear proposition of integrity toward traders, to automate their experience yet give a credible and proper series of licensed financial advisers who would be able to align their services with the interest of traders and ensure that they succeed for longer, whilst reducing brokerage staffing costs and moving away from the lead calling and sales model to make the churn and hard sell necessity a thing of the past.