For FX brokers, monetization and staying competitive is Excel Hell! Live from Guangzhou

How to steer a brokerage forward is not an easy task for executives and CFOs, largely due to very fast developments in the FX industry and the use of reporting systems that are not up to speed. We look at how this can be changed, and how Israel’s Prime Minister Benjamin Netanyahu agrees that running a lean and efficient model, and why the modernization of reporting and accounting is the only way to drive revenues going forward

The method by which accountancy and future strategic planning is conducted within a large number of companies these days across all industry sectors is at best just about relevant, and at worse downright archaic.

In the FX industry, however, there is no system that yet exists that can be used by senior accountants and Chief Financial Officers that is ergonomically refined and quick enough to maintain pace with the rapid development of the OTC derivatives industry in which entire turnarounds can occur within just six months and planning and delivery of new initiatives is faster than within almost every other large-scale business.

Archaic methodology is familiar, and used worldwide, which is the reason for its continued prominence and ubiquity, but in a global industry the size of the electronic financial markets sector, it’s just not possible to extrapolate relevant data in a sufficiently timely manner, resulting in several inaccuracies of data and potential losses in revenue or missed opportunities.

Today, here in Guangzhou, China, at the “Fortune Forum” hosted in association with FXWord, FinanceFeeds stepped outside of the all-familiar FX industry and the array of ancillary service providers to speak to a specialist in providing modern solutions to Chief Financial Officers of large scale businesses and governments around the world.

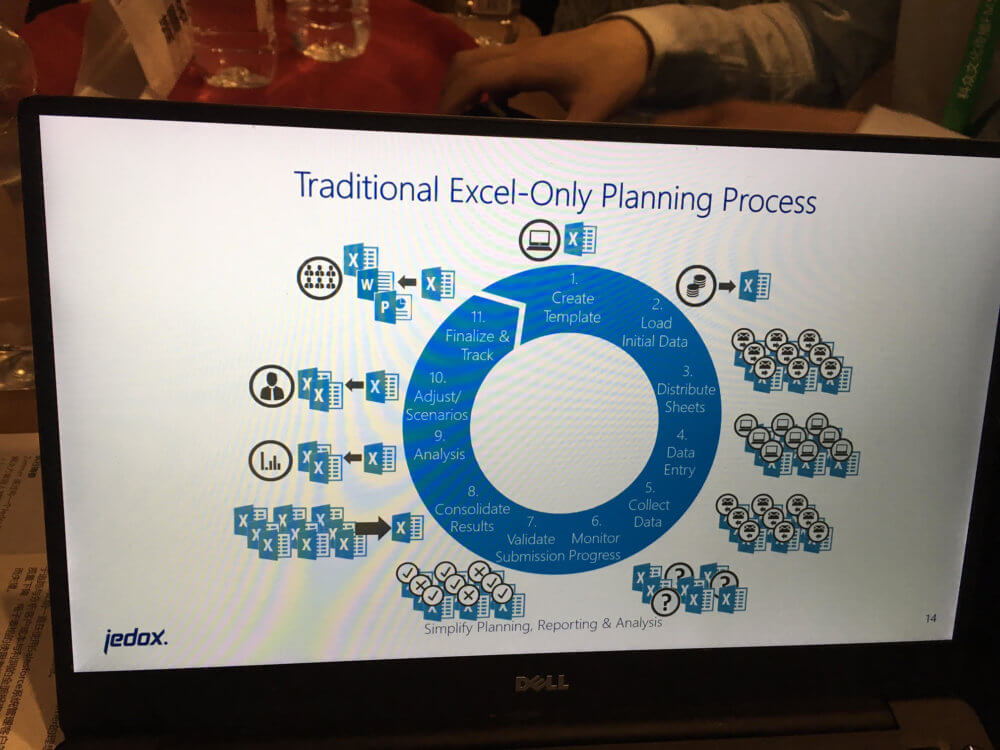

Speaking with Brendan Fraher, Director of Sales Asia at German software company Jedox today, an interesting point was made with regard to how the FX industry leads the entire world in terms of technological development and in particular the speed of development cycle to implementation, but is held back by age old Excel spreadsheet-driven forecasting and financial planning.

Jedox, which is a client-server software that is used to create performance management solutions for data analysis had its first stable release in March 2017, and operates on a cross platform basis using Linux and Windows.

Mr. Fraher, who is based in Singapore and has substantial experience in working closely with Chinese financial services firms alongside a radius of other industry sectors, explained today “We all know that in the financial sector, everything runs on spreadsheets. People have built their careers around spreasheets, which is understandable as they are flexible, executives can build with whatever they need and it is prefered by a wide range of people in many positions within companies becuase it is an advanced calcluator.”

“Companies are trusting the storage and delivery of complex information so they are very loyal to what they know works. There are a lot of horror stories about firms using huge shared spreadsheets, where data gets either viewed by other parties, or is accessible and can be deleted in error by unrelated entities. In some cases, firms have multiple shets that are being used by different departments, and they get sent to a central place and are pieced together to collate the information. This of course has become an accepted practice almost everywhere” said Mr Fraher.

There is no time for this in FX

“Imagine that you have a circumstance where spreadsheets contain critical financial data which is to be used to make strategic future decisions. These would take a very long time to put together, so I have to ask whether companies in that sector are making informed decisions on real time data, or whether by the time the information has been compiled, it is already obsolete” – Brendan Fraher, Director of Sales Asia, Jedox

“What if you could keep the benefits of Excel but eliminate the challenges with regard to time and the likelihood of errors as a result of many people adding their already collated data to existing sheets” said Mr Fraher.

“This resonates heavily with the FX and OTC derivatives industry” he continued.

“Brokers complete their trades and send their full reports every day for reporting. They also have to collate the revenues for their own internal purposes, so that they can have accurate real time figures regarding how the company is performing, and can build strategies ahead. The companies need to look at the actuals, then make an analysis and make a plan to improve the performance of the company, but it cannot take three to four months to do this, as it often does for company accountants to produce such a report” he said.

“By using a modern system such as Jedox, this allows companies to simplify budgeting, analysis and reporting in one solution” explained Mr Fraher.

“In my opinion, all of the noise made recently about Big Data, Business Intelligence, is all irrelevant. There is no move in the direction of any of the Big Data providers by the majority of large corporations, they are all still using Excel” – Brendan Fraher, Head of Sales Asia, Jedox

“Ernst & Young says 99% of the world runs on spreadsheets. The reasons are quite obvious, that they are fast from a user perspective, simple, and everyone is used to them for many years. The difficulty arises when going to enterprise enviromment, where it then becomes very clear that Excel is not error proof and not audit-compatible” he said.

“The numbers are the lifeblood of orgnaization” said Mr. Fraher. “Whether it is trading information, volumes, revenues or the actual trades themselves, these are absolutely vital and cannot be made too late, or have incorrect data.”

“Toshiba was making commercial decisions to go in specific directions based on false numbers, because of errors when collating spread sheets and obsolesence of data” he explained. It takes too long to make a spreadsheet to make a plan in real time. Companies in the electronic trading business, cannot wait months for critical data when they are fast moving, liquid and things change all the time.”

“From a basic accounting perspective, most retail firms need to look at look at simple cost vs revenue – $2 spend, $10 in. That’s a business. In order to do that you need costing and performance information. This information is critical to be able to decide what to do with an organization at any one time. If you do not have that in real time relevent state, it’s no good” said Mr Fraher.

Let’s make all this simple

“Standard Excel procedure creates long working days, often late delivery and leads to mistakes, largely down to obsolesence of data and also because of lots of departments doing different things for different divisions of the company on separate spread sheets and then adding them together” explained Mr. Fraher. “They all then export the report individually, send it to a central part of the company, so therefore it then takes a while for the big management report to be integrated.”

“Why not do it the other way? he asked. “Point everyhting into one root, but access it via that root using Excel. Every time someone writes ssomething new in Excel, it is automatically put in the root, this allows data to be stored in its realtime format centrally, and not on offline spreadsheets which then have to be put together. Instead, the Excel sheets are empty, and the database has the information” explained Mr Fraher.

“By doing it this way, the senior management is looking at the company in real time, and the FX industry has such a fast development cycle that it is ideal for this type of reporting.”

“Even in actual trading, this applies. If a news event happens, and everyone says OK let’s short US dollars, and therefore the market changes, real time reporting can then be looked at to be able to manage the situation. Companies can use strategic planning in real time for this. The forecast then becomes the new actuals and then the process is repeated. This is much more effective than using silos and Excel” said Mr. Fraher.

In China, Noah Ark is a highly respected treasury system. The majority of it runs on Excel, they know how it is used. There would be massive disruption to take all that out and replace it. So the best way is to modernize by taking 4 weeks on one project and looking at the time and efficiency differences” he said.

“Change resistance is a major issue today, largely due to concerns over loss of intellectual property, outages, cost of implementing new systems and the problems associated with skill base, as every employee is used to the same format that has been around for several years. Systems such as Jedox will certainly go some way toward stopping that” explained Mr Fraher.

In terms of security of data, brokerages are very concerned about their data, because in the retail sector, that is the value of their business.

An endorsement of this is the recent onboarding of Jedox by the Israel Ministry of Security – one of the most widely respected national government security departments in the entire world.

The new system, called Numerator, is based on such analytics. From now on, when a minister or member of parliament calls on the Minister of Finance to change or add budget items, the modification will be impossible to approve unless every expenditure points to an expected source of revenue. The Numerator will immediately trigger a Deficit alert, and force the budget planner to specify the budgetary source of revenue. This is absolutely relevant to running an FX brokerage.

Decision makers will be able to make an exception, but those shall be monitored – a deficit item will be created, to be added to future liabilities to be taken into consideration by those preparing the next budget. When Finance Minister Kahlon introduced the Numerator system to the ministers, Prime Minister Netanyahu said it was “a revolutionary system which will affect the management of the Israeli economy. With this technology, in two years Israel will have no need for budget cuts.”

Mr Netanyahu was Finance Minister in the mid 1990s, and is certainly one of the most experienced and astute accountants to have ever been in public office. His policies created a thriving State of Israel in which living standards rocketed skywards, and set the path for the country, under Bank of Israel Chairman Stanley Fischer, to have had absolutely no impact whatsoever from the economic crisis of 2008 and 2009.