French regulator defines risk associated with crypto-asset fraud as material

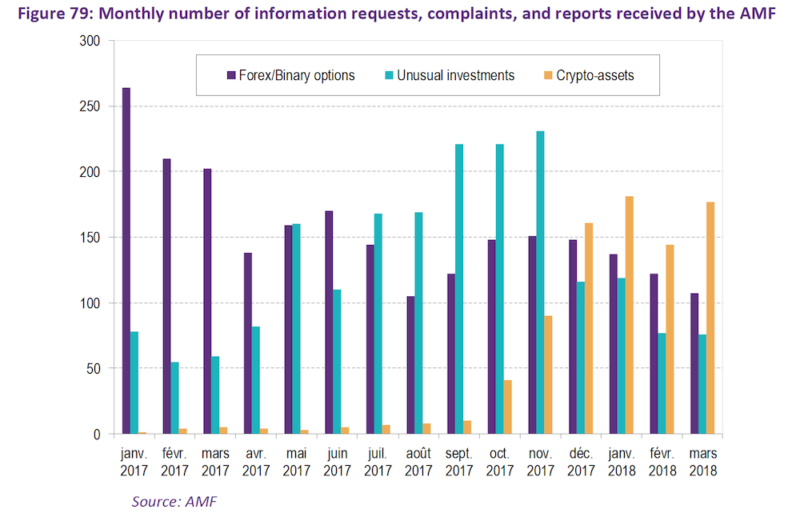

According to the AMF, the current level of risk associated with crypto-asset fraud is higher than in 2017.

France’s financial markets authority AMF warns of growing risks stemming from cryptocurrency fraud. This becomes clear from the recently issued 2018 Markets and Risk Outlook, an annual risk assessment based upon the economic, financial and regulatory evolutions.

In particular, the French regulator is worried about the lack of investor protection when there is little information about the risks associated with certain investments or distribution channels. This concerns the build-up of new waves of fraud related to crypto-assets, the AMF says. The risks stemming from this type of fraud are material, according to the regulatory estimates. The risks are higher than in 2017, the AMF warns.

Following the intensification of the regulator’s pressure on illegal websites offering trading in Forex or binary options, the fraudsters have quickly turned to investment diamonds and miscellaneous assets. The regulator was able to react quickly to contain this new wave thanks to the tools made available by the Sapin 2 Law. However, the end of 2017 was marked by the emergence of investment offers on crypto-assets, such as Bitcoin, suggesting that fraudulent players have been able to shift their focus.

Unfortunately, the current legal and regulatory framework is not adapted to these new products, which strongly constrains the AMF’s ability to act, the regulator warns.

Crypto-currencies and other crypto-assets are not covered by the legal definition of a currency or even, in most cases to date, a financial instrument under French law, which raises the issue of the competence of the various authorities. An in-depth legal analysis conducted by the AMF earlier this year led to the conclusion that crypto-asset derivatives (regardless of the legal nature of the underlying) could qualify as financial contracts and should therefore be subject to the regulation applicable to the offer of financial instruments in France and in particular to the rules of the Monetary and Financial Code concerning approval, good conduct, and the ban on advertising.

Regarding the legal nature of tokens, the AMF notes that it can be highly variable from one transaction to another. In most cases, they simply give a right to the future use of the service proposed by the entrepreneur, at a preferred rate (utility tokens). The initial valuation of the token during its issue (“primary market”) remains questionable. In some cases, tokens can be traded on a “secondary market” at a price determined by the interaction between supply and demand at a given moment. Investors are thus betting on the project’s success and the future appreciation of the token’s value (if it is actually traded on a “secondary market”).

Like other crypto-assets, tokens generally do not have the characteristics that qualify them as financial instruments in France. However, if a promise of a return is made in the advertising of these offers or if the issuer offers a buy-back option to the investor, the “intermediation in miscellaneous assets” regime must apply, and the advertising documents must be approved by the AMF. Unless they indeed qualify as financial instruments or fall within the intermediation in miscellaneous assets regime (which is rare), ICOs, and other investment transactions on crypto-assets are currently outside the scope of the regulation.

In order to develop a legal framework that would combine support for innovation with investor protection, the AMF conducted a public consultation on ICOs at the end of 2017 and plans to continue the work of defining a regime specific to ICOs. The PACTE act, which is currently in the works, could give the AMF a legal framework to support its action.