FX brokers begin to emulate large institutions with quarterly reports for traders

Australian FX brokerage Royal Financial Trading is spearheading the move toward professional research and quarterly reporting for traders. FinanceFeeds meets with CEO Andrew Taylor to gain a detailed view

It has long been apparent that the standards expected by retail traders in the multi-asset derivatives sector are at a very high level and have been ever since the maturity of the online FX brokerage businesses that now adorn the world’s major financial centers.

For this reason, quite simply providing similar, outsourced platform environments to a very specifically targeted client base, brokerages are at an evolutionary crossroads at which the need to emulate the institutional sector and provide reports and data in the same vein as large professional services consultancies such as KPMG and Accenture.

Today’s traders are very much part of the information age, and certainly at the recent Professional Trading Thought Leadership Conference hosted by FinanceFeeds in London, leading institutional hedge fund managers, algorithm developers, listed derivatives experts and proprietary traders with over 30 years of experience each discussed the importance of providing granular and relevant information about the markets to traders in order that they are able to analyse their trading in the best possible way.

FinanceFeeds met with Andrew Taylor, CEO of Australian FX brokerage Royal Financial Trading, in order to look at the firm’s recently compiled Markets Outlook for the first quarter of 2019, which represents a new initiative by the company to generate fully comprehensive reports for each quarter of the year.

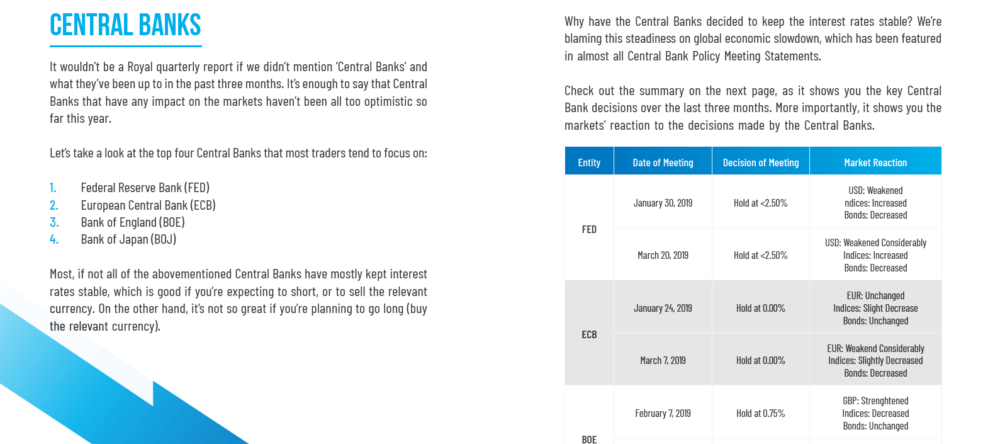

The Q1 report, which features 65 sections relating to the entire structure of capital markets ranging from analytics on central banking issues, to perspectives on trading tools, editorials from professionals, and how to keep funds secure to full discussions on news events over the first quarter of the year, is intended to ensure that traders are equipped with as much detailed information as possible, and to elevate the retail FX sector’s information presentation toward that of management consultancies, audit firms and major institutions.

“When it comes to trading, and more importantly, trading well, it’s wise to seek out knowledge from traders and analysts who have been there, done it, and worn the famous trading t-shirt. That’s where this quarterly report comes in, as the Royal Market Analysis Team has been hard at work, looking over the markets from January through to March of this year” considers Mr Taylor.

“The reason why we compiled this is that I believe all brokers should be producing quarterly reports on the markets to look forward. We should be producing reports for the first quarter of each year, through to the third quarter, all of which take a detailed look at the previous quarter, and then at the end of each year, produce a year-end report to look back at the entire year and capture the full year’s news and market information, whilst then looking at what may happen in the year ahead” said Mr Taylor.

“We will produce a hardback edition to send to our largest clients and I think it is important to create a library of all of the information that have compiled as time goes on. I think the way that much of the electronic brokerage industry is working right now to provide information is not the most effective, therefore I am very keen on disruptive marketing, and this is disruptive” he said.

“Having something tangible that enables people to see what is happening in the market is vital. It is written in a way that everyone can understand, rather like the material that has been produced by firms such as PriceWaterhouseCoopers or firms that provide outsourced infrastructure to financial institutions such as Fujitsu-Siemens. That is the level of information distribution that we were aiming for” explained Mr Taylor.

“Market Analysts need to realize that 90% of retail traders are new to trading and therefore it needs to be written in a format that is understandable. Our series of reports exists to show who the firm is and what we are doing, and what we are going to be doing, whilst providing very detailed information on all aspects of the global market structure” he said.

“We are a large company with over 125 staff worldwide, and we have a very established presence, however this report is not to show off, it is to demonstrate to traders what they can expect from us. If I can be really cliché, it is very important that things are done professionally and I wanted to ensure that we have very high standards, and in general the retail sector needs to operate at a very high level these days. I think that it is time that people got to see who we are and what we can do for our traders” said Mr Taylor.

“Our Marketing Director came to the firm from a Marketing Technology position at 3CX. He was head of marketing there for 3 years and the company used to produce a datasheet every year. We need to start acting like technology firms, as we are the bridge between the trader and the markets and therefore the more that we in the retail FX industry can assist the traders, within the regulatory parameters, the better it is for the entire business as a whole” said Mr Taylor.

The electronic version of the Royal Financial Trading Q1 Report can be viewed here.