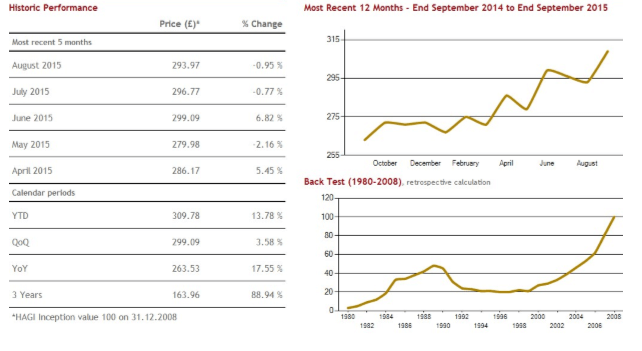

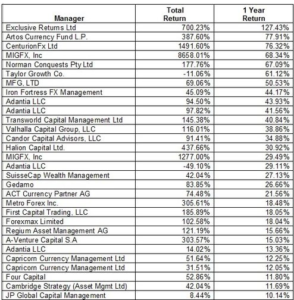

FX hedge fund average annual ROI: 50%. Classic car average annual ROI: 50%!

As average returns on investment among FX hedge funds begin to be similar to that of classic cars, we look at the difference between collecting classics and trading the markets.

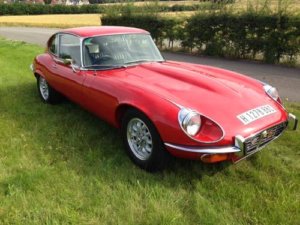

An eight hour daily stint on an institutional proprietary trading or hedge fund desk, or scything through the countryside in a 1971 Jaguar E-Type V12. That is the question.

Electronically executed, highly liquid and constantly pushing the boundaries of technology in order to gain an advantage in the rapidly fluctuating currency markets, requiring extreme concentration and continual study of all aspects of the entire electronic trading landscape using signal tools, dedicated connectivity and an investment in all-encompassing market and infrastructure knowledge that takes several years to acquire, is a science which the world’s top traders have to keep on top of all the time.

Every day, professional traders consider latency, trade execution, routing, checking and forwarding orders within a split second, ensuring that they come out on the right side of as many trades as possible to gain the return on investment for either his employer (if a proprietary shop) or client (if a hedge fund).

But what if there was a devil’s advocate here. What if the same percentage gains on average per year could be achieved by owning a classic car, which by comparison to the leading edge and frenetic world of institutional FX trading, is retrograde in its technology, and does not require any continual concentration, its time-consuming facets being constant and proper maintenance to uphold its originality and pedigree.

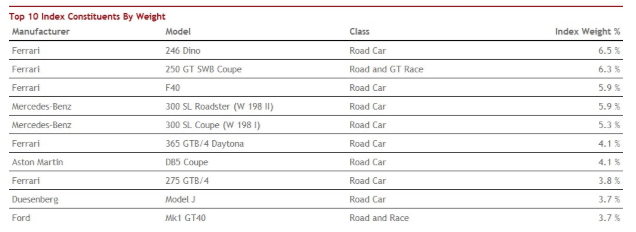

The Historic Automobile Group International (HAGI) Index, which is compiled in London by this organization which conducts and compiles research on rare historic automobiles and presents them in the form of indices has compiled research that hows that investors in classic cars have achieved price increases of 500%.

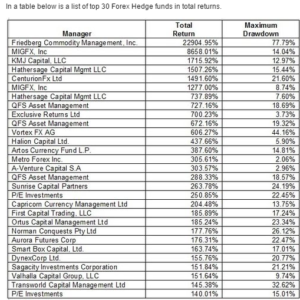

That is on a par with some of the largest FX dealers and hedge funds in the world.

This is a remarkable metric indeed, however it is important to be clear as to what actually constitutes a classic car. In this case, as in all cases which involve the consideration of a physical object, usually a rare and collectible one, as an asset class, the investors which have reaped the same return on investment as that of an FX hedge fund are not those who own a garish mid-1980s hot hatchback, or a vulgar customized 1970s common man’s express with tinted windows.

Pedigree is all. None of said classics, even if from a thoroughbred stable, have been subjected to anything other than top quality maintenance at the hands of true enthusiasts and purists. He who seeks to defile his Rolls Royce toolkit for repairing the lavatory is not the sort of chap you should be doing business with.

Neither are those who embellish their ‘pride and joy’ with tasteless hood adornments, gold trims and wheel arch extensions. Such mutilation will affect the value as much as it will offend the eyes.

Although these classics may not be to everyone’s taste, from an investment point of view, they have proved their worth recently.

in August 2014, a 1962 Ferrari 250GTO Berlinetta (coupe) was sold at Bonhams in California for $38,115,000, setting a world record for a car sold at auction.

One year previously, a Ferrari 250GTO was sold privately for $52 million.

Ten years ago, the value would have been approximately $3 million for an outstanding example.

I personally find Ferraris to be vulgar, whether classic or modern, however clearly there are those who do not, and with the racing pedigree from the 1940s to 1960s cast in stone, the demand among investors is huge.

Another perhaps odd example of a rapidly appreciating classic involves the notoriously slow and difficult to drive VW Campervan (I will NEVER understand the attraction to these abominations) which have appreciated so much that a 1950s ‘split screen van – probably the very worst of the entire range – had reached an astonishing £91,000 in Britain in the summer of last year. Those were worth a maximum of £10,000 – still £9,999 too much in my opinion – just ten years ago.

The Lamborghini Miura, quite a magnificent piece of early 1960s automotive art, was the result of a feud between Ferruccio Lamborghini and his former employer Enzo Ferrari. Ferrucio Lamborghini had succeeded in manufacturing agricultural machinery, before joining Ferrari as an engineer, at which point the two industrialists did not get along, so to spite Mr. Ferrari, Mr. Lamborghini set about making a better car and succeeded.

The Miura P400-SV was a relatively affordable classic in the median years of last decade, however last summer, one example in North America was sold for $2,475,000 when just ten years previously these adorned the classified advertisements for approximately $200,000. Of course the ghastly Countach which replaced it in 1971 cannot be considered a classic, and therefore is not an investment opportunity.

Unbelievably, values of the really rather ordinary and sleep-inducing VW Golf GTI Mk1 (1975 to 1983) rose 33% in the first six months of 2015 on the British market. Who would pay £10,000 for one I have no idea, however its return on investment outstripped that of many FX traders in the same period.

A beautiful Jaguar E-Type V12 automatic (the best of the entire E-Type line in my opinion) will this week set you back £42,000. Just ten years ago, the purists were continuing their penchant for the Series 1 and 2 six cylinder E-Types, which meant that the fantastic V12 languished at a value of under £10,000. The hardest part of that winning trade would be watching the new owner select Drive and pull away.

Looking at these prices, and the scale of the increases in value of many sought after classics is outstripping the electronic trading giants. Perhaps the controversial question may be as to when historic vehicles will become listed as an asset class on electronic trading platforms on a deliverable basis. Now there’s a thought of how to combine the old and the new!