FXCM.com removes all mention of Non Dealing Desk model

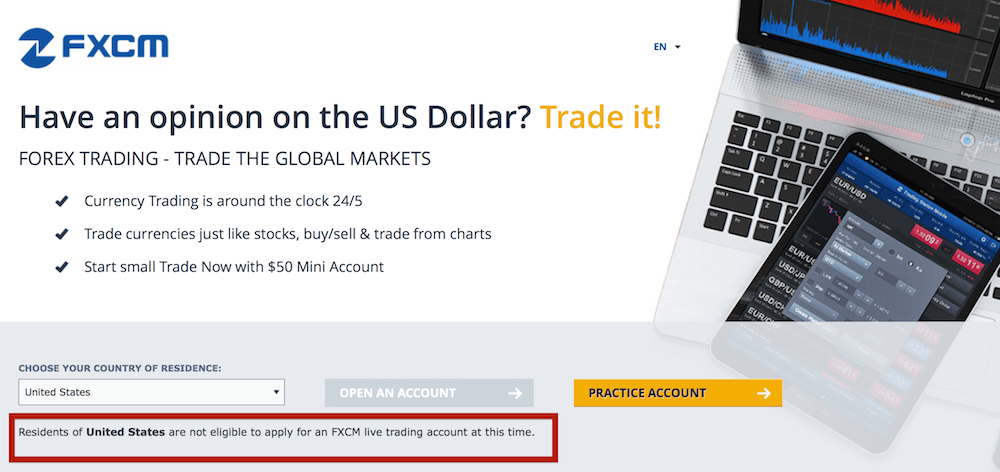

Residents of a number of countries, including the United States, the Russian Federation, Hong Kong and Singapore, are not eligible to open live accounts with FXCM at this time.

The website of what was once a major retail FX broker in the United States, now looks more like a landing page redirecting customers to FXCM Group’s non-US subsidiaries.

FXCM.com now features no mention of the broker’s once widely hailed Non Dealing Desk model. This barely comes as a surprise given the recent action by US regulators which have uncovered that Forex Capital Markets LLC misled its customers and regulators with regards to the application of the Non Dealing Desk execution during several years.

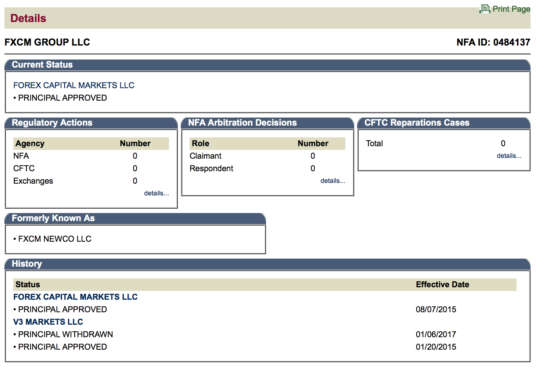

For that matter, let’s also note that the latest version of FXCM.com excludes all references to Forex Capital Markets LLC. This is the entity that was formally barred from membership in the United States National Futures Association (NFA) and the Commodity Futures and Trading Commission (CFTC). Interestingly, the NFA Basic Search portal still shows Forex Capital Markets LLC is registered – this is about to change soon, however, as the period for abandoning membership is close to its end.

FXCM Inc is no longer present on the website either, which is normal, given that FXCM Inc has changed its name to Global Brokerage Inc (NASDAQ:GLBR).

Instead, FXCM.com now puts the stress on the FXCM Group, which is currently a principal of Forex Capital Markets LLC, according to the NFA database, and is headquartered at New York.

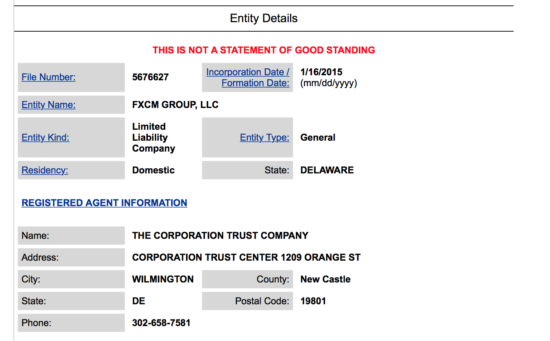

You can also view the data from the Delaware Division of Corporations below.

FXCM.com notes that Forex Capital Markets Limited (“FXCM LTD”) is authorised in the UK by the Financial Conduct Authority, whereas FXCM Australia Pty. Limited (“FXCM AU”) is regulated by the Australian Securities and Investments Commission. There is also a reminder that FXCM has unregulated subsidiaries – FXCM Markets Limited, which was established in the spring of 2013, and FXCM Global Services, LLC.

Talking of FXCM’s non-US businesses, let’s note that the site of FXCM UK, for instance, still features information about the Non dealing desk, saying that FXCM “pioneered the No Dealing Desk forex execution model”.

Customers in several jurisdictions are not currently eligible to open live trading accounts with FXCM, according to the drop down menu on the updated website. The list of such jurisdictions (not exhaustive) includes the United States, Virgin Islands (US), the Russian Federation, Ukraine, Turkey, Singapore, Japan, and Hong Kong. The practice account remains an option.