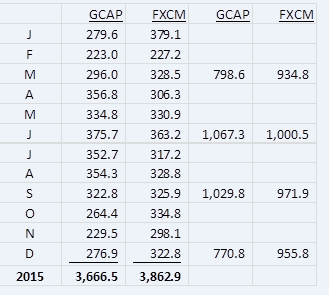

FXCM trounces GAIN Capital in overall volume for 2015 as December’s volumes round off a strong year

FXCM Inc (NYSE:FXCM) has today announced its metrics for the month of December 2015, rounding off a very interesting year in which the company stood tall among giants. The company’s monthly volume for the firm was 8% up over the previous month, however the interesting aspect here is that FXCM’s performance in volume terms has, […]

FXCM Inc (NYSE:FXCM) has today announced its metrics for the month of December 2015, rounding off a very interesting year in which the company stood tall among giants. The company’s monthly volume for the firm was 8% up over the previous month, however the interesting aspect here is that FXCM’s performance in volume terms has, over the course of the last year, been higher than that of its closes peer, GAIN Capital.

Retail Customer Trading Metrics

* Retail customer trading volume of $323 billion in December 2015, 8% higher than November 2015 and 9% lower than December 2014.

* Retail customer trading volume for the fourth quarter 2015 was $956 billion, 2% lower than the third quarter 2015, and 16% lower than the fourth quarter 2014.

* Retail customer trading volume for the full year 2015 was $3.9 trillion, 10% higher than full year 2014.

* Volume from indirect sources was 37% of total retail volume(2) in the fourth quarter 2015.

* Average retail customer trading volume per day of $14.7 billion in December 2015, 4% higher than November 2015 and 14% lower than December 2014.

* An average of 501,108 retail client trades per day in December 2015, 3% higher than November 2015 and 5% lower than December 2014.

* Active accounts of 177,847 as of December 31, 2015, a decrease of 2,058, or 1%, from November 2015, and an increase of 12,562, or 8%, from December 2014.

* Tradeable accounts of 161,632 as of December 31, 2015, an increase of 123, or 0.1% from November 30, 2015, and a decrease of 27,528, or 15%, from December 31, 2014.

Institutional Customer Trading Metrics

* Institutional customer trading volume of $36 billion in December 2015, 12% lower than November 2015 and 51% lower than December 2014.

* Institutional customer trading volume for the fourth quarter 2015 was $111 billion, 15% lower than the third quarter 2015, and 55% lower than the fourth quarter 2014.

* Institutional customer trading volume(2) for full year 2015 was $534 billion, 48% lower than full year 2014.

* Average institutional trading volume(2) per day of $1.6 billion in December 2015, 20% lower than November 2015 and 54% lower than December 2014.

* An average of 29,469 institutional client trades per day in December 2015, 7% lower than November 2015 and 56% higher than December 2014.

In addition, FXCM has updated its expectation regarding the sale of non-core assets and the repayment of its loan with Leucadia National Corporation.

While the Company remains positive about the ongoing sale processes, they may not be completed within the first quarter of 2016 as previously indicated. FXCM is now targeting the repayment of its debt to Leucadia by the second quarter of 2016.

More information, including historical results for each of the above metrics, can be found on the investor relations page of FXCM’s corporate website .

This operating data is preliminary and subject to revision and should not be taken as an indication of the financial performance of FXCM Inc. FXCM undertakes no obligation to publicly update or review previously reported operating data. Any updates to previously reported operating data will be reflected in the historical operating data that can be found on the Investor Relations page of the Company’s corporate website.

It is important to note that FXCM’s Customer Trading Metrics from Continuing Operations excludes discontinued operations of FXCM Japan and FXCM Hong Kong, and that the volume that FXCM customers traded in period is translated into US dollars.

FXCM has confirmed that when referring to an active account, this represents an account that has traded at least once in the previous twelve months, and that a tradeable account is an account with sufficient funds to place a trade in accordance with FXCM trading policies.

Photography at FXCM’s Head Office in New York copyright Andrew Saks-McLeod