FXCM UK representative pays £963,859 in dividends to directors in 2016

Opal Core, the single currently authorized representative of FXCM UK, reports that it paid dividends worth £963,859 to its directors in 2016. This compares with total comprehensive income of £912,757.

Following the February events from this year, a lot has changed at FXCM. FXCM Inc got a new name – Global Brokerage Inc (NASDAQ:GLBR), whereas Forex Capital Markets Limited (FXCM UK) has become the center of FXCM Group’s business. In fact, FXCM UK’s head Brendan Callan was promoted to CEO of FXCM Group on May 15, 2017.

These are among the reasons to keep an eye on the developments around FXCM UK.

Last week, a small company named Opal Core Limited published its unaudited accounts for the year to December 31, 2016. This company, whose nature of business (according to Companies House) is administration of financial markets, is an authorized representative of FXCM UK. To be more precise, Opal Core is the single authorized representative of FXCM UK at present.

Opal Core’s corporate website confirms that the entity is an FCA-regulated authorized representative for Forex Capital Markets Limited. It says that Opal Core specialises in the provision of institutional liquidity to regulated financial institutions in Turkey, the Middle East, and Europe.

According to the website, the company was founded in 2010 by Ahmet Kemal Hilmi and Lisa Osborne, its two active directors as per the UK Companies House service.

There is not much to find in a report by a small company that may use a raft of exemptions, including an exemption from an audit of its reports.

Nevertheless, we were curious to take a look at the statements.

In the year to December 31, 2016, Opal Core paid dividends totalling £963,859 (2015: £543,421) to its directors. Also, during the year, the company paid advertising and marketing fees totalling £146,500 (2015: £118,500) to companies which are connected to the directors.

This compares with total comprehensive income of £912,757 for the year. The current assets amounted to £274,376 at the end of the reporting period, whereas the net assets were £37,878.

How the amount of dividends fits with the smaller income is a question for deliberation.

According to the UK regulations, an appointed representative is a firm or individual that can act on behalf of another firm or individual (its ‘principal’) that is authorised by the PRA and/or the FCA. Appointed representatives and tied agents promote or deal in the products of their principal rather than all products in the market.

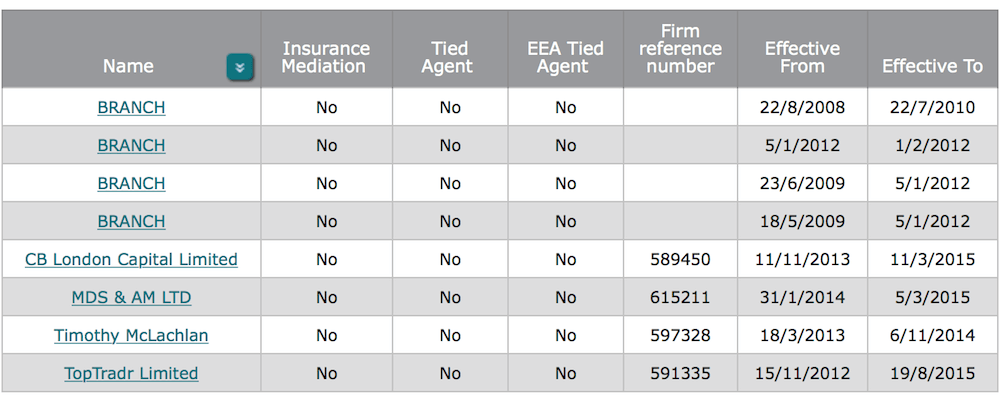

FXCM UK has bid goodbye to three authorized representatives following the January 15, 2015 events. The list includes CB London Capital Limited, MDS & AM Ltd, and TopTradr Limited.

In the face of what happened to the US operations of the broker, FXCM UK does not expect any regulatory action from the Financial Conduct Authority. In its annual report for 2016, FXCM UK stated that:

“The Company’s Board has received thorough explanation of all the matters outlined in the CFTC and NFA letters, both from FXCM Group’s general counsel and external law firms engaged to represent the FXCM Group during the settlement process. After such an explanation the Board is satisfied that no customer detriment to the Company’s clients has occurred, neither have clients been misled as to the execution policies of FXCM Group. We are therefore comfortable that the Company will not be put into enforcement with the FCA and will not face any fines or public sanctions.”