FXCM’s website shows new logo, as name is officially changed

FXCM Inc now has a new name and a new logo, with the State of Delaware confirming the change is effective as of February 24, 2017.

The flood of announcements regarding FXCM Inc (NASDAQ:FXCM) continues to grow, as the “Investor Relations” section of FXCM’s website was the first to display the new logo of the broker, along with a SEC filing about the official name change.

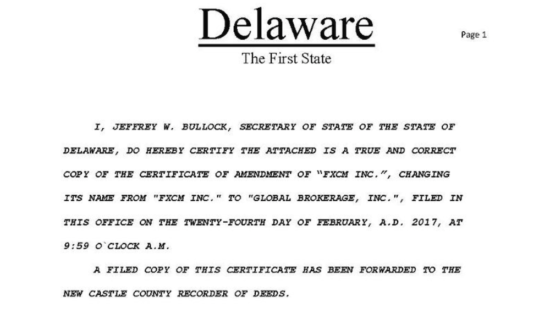

The SEC filing features a scanned copy of an announcement by the Secretary of State of the State of Delaware, showing that the name “FXCM Inc” was changed to “Global Brokerage, Inc”. The amendment to FXCM’s registration became effective on February 24, 2017.

Today, FXCM, or Global Brokerage, Inc, also published its amended and restated bylaws that substitute the old name with the new one.

We are awaiting for the change to the Nasdaq ticker of FXCM to become effective later today – the new one is “GLBR”.

![]() Meanwhile, earlier today, Leucadia National Corp. (NYSE:LUK) has reported its financial results for 2016, with the focus of the FX industry on what the group had to say about FXCM.

Meanwhile, earlier today, Leucadia National Corp. (NYSE:LUK) has reported its financial results for 2016, with the focus of the FX industry on what the group had to say about FXCM.

Leucadia estimated that its maximum exposure to loss as a result of its involvement with FXCM was equal to the sum of the carrying value of the term loan ($164.5 million) and the investment in associated company ($336.3 million), which amounted to $500.8 million at December 31, 2016.

At the end of 2016, Leucadia had a 49.9% membership interest in FXCM and up to 65% of all distributions. Leucadia notes it does not hold any interest in FXCM Inc., the publicly traded company, and that Leucadia owns the remaining 49.9% of FXCM Group, LLC, and its senior secured term loan is also with FXCM Group, LLC, which is a holding company for all of FXCM Group, LLC’s affiliated operating subsidiaries.

Commenting on the potential consequences from FXCM’s US retail FX market exit and the recent regulatory action against the broker, Leucadia was not very optimistic:

“It is difficult to anticipate all of the ramifications of the recent regulatory settlement between the NFA, the CFTC, FXCM Holdings, FXCM U.S., and certain of its principals, including the impact to its relationships with customers, regulators outside of the U.S., and other entities with which the subsidiaries of FXCM transact, any of which could materially impact the value of our investment in FXCM.”