Gain Capital – Forex.com UK to focus on returning its licenses to FCA

In the annual report, directors of Gain Capital – Forex.com UK say that after the cessation of trading of the company last year, the focus this year would be on canceling its FCA licenses.

The key aim of Gain Capital-Forex.com UK Limited, a subsidiary of Gain Capital Holdings Inc (NYSE:GCAP), for this year is to cancel its Financial Conduct Authority (FCA) licenses. This becomes clear thanks to the annual report for the year to December 31, 2016 that the company has just submitted with the UK Companies House service.

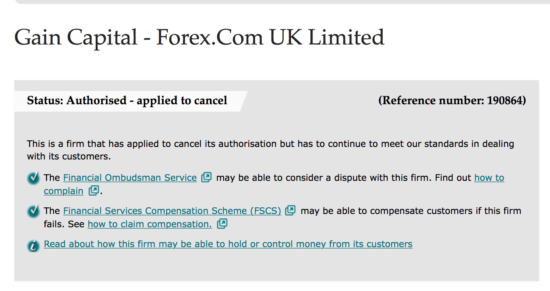

According to the FCA register, the status of Gain Capital – Forex.com UK Limited is “Authorised – applied to cancel”.

This is barely a surprise to those monitoring the developments around Gain Capital’s UK business, as it has been undergoing some structural changes for at least a couple of years. This has to do, inter alia, with the acquisition and integration of City Index, as well as with the launch of Gain Capital Payments.

While we are looking at GAIN’s UK operations, let’s also mention the latest information that we have from the SEC filings from the ultimate parent of GAIN Capital-Forex.com U.K. Ltd. and GAIN Capital UK Limited. According to these filings, these businesses are each registered in the United Kingdom and regulated by the Financial Conduct Authority as full scope €730k IFPRU Investment Firms. At March 31, 2017, GAIN Capital-Forex.com U.K. Ltd. maintained $16.2 million more than the minimum required regulatory capital for a total of 3.4 times the required capital.

According to the annual report for 2016, Gain Capital – Forex.com UK Limited, ceased trading in August 2016 and the entire client base was transferred to Gain Capital UK Limited.

Cash at bank during the year decreased to $13.7 million (down from $63 million in 2015) due to repayment of inter-group loans and the payment of dividends. Gain Capital – Forex.com UK Limited registered a loss after taxation of $3.2 million, compared to a profit of $24 million in 2015. Operating profits fell to $11.65 million, compared to $30.81 million a year earlier.

The company aims to release the remaining assets on its balance sheet. The Directors state that they believe the company will be able to continue its operational existence for the foreseeable future.