GAIN Capital posts $41m in revenues for April 2020

Net income for the period from April 1, 2020 to April 30, 2020 amounted to $11.9 million.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) today made public a SEC filing disclosing certain preliminary, unaudited financial and operating results for the period ended April 30, 2020.

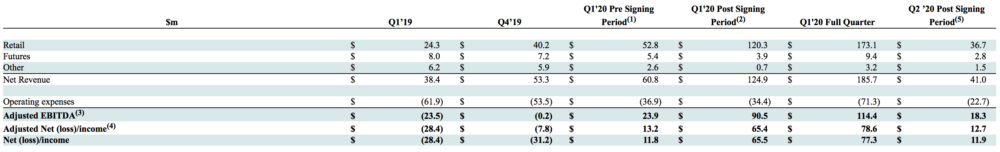

The broker explains that the volatility during the period commencing on February 27, 2020 (the first trading day following the signing of the merger agreement with INTL FCStone) and ending on March 31, 2020, the last day of the first quarter of 2020 (which period is referred to as the “post-signing Q1 period”), increased very significantly as compared to both the period commencing on January 1, 2020 and ending on the date the merger agreement was signed, February 26, 2020 (which period is referred to as the “pre-signing Q1 period”) and the first quarter of 2019.

Specifically, average daily trading volume (“ADV”) during the post-signing Q1 period was $17.8 billion, a 123% increase from $8.0 billion, the ADV during the pre-signing Q1 period, and a 131% increase from $7.7 billion, the ADV during the first quarter of 2019. Similarly, the heightened volatility resulted in a significant increase in retail revenue per million (“RPM”) during the post-signing Q1 period, which increased to an RPM of approximately $281 during the post-signing Q1 period, an increase of 71% and 462% from an RPM of $164 and $50 in the pre-signing Q1 period and the first quarter of 2019, respectively.

GAIN’s results of operations increased sharply during the post-signing Q1 period, with approximately 67%, 85% and 83% of the aggregate revenue, net income and adjusted net income, respectively, for the first quarter of 2020 generated during the post-signing Q1 period.

GAIN’s net revenues amounted to $41 million in the Q2 post-signing period (the period from April 1, 2020 to April 30, 2020). Net income reached $11.9 million in April.

The GAIN board says it continues to recommend that the merger agreement be adopted by the stockholders of GAIN, by a vote of seven to one. However, the subsequent developments that have occurred following the signing of the merger agreement, resulted in the GAIN board continuing to review its recommendation, including both the positive and negative factors which the GAIN board considered in arriving at its initial positive recommendation.

Furthermore, the GAIN board has, with the assistance of its financial and legal advisors, reviewed, and continues to review, its rights under the merger agreement, including without limitation the GAIN board’s right, subject to compliance with certain restrictions in the merger agreement, to make an adverse recommendation change in connection with a “company intervening event”.

The GAIN board will continue to review its rights under the merger agreement, including its rights relating to the determination of the existence of a “company intervening event” and changing its recommendation to the GAIN stockholders up to the time of the special meeting.