GAIN Capital reports net loss of $2.1m in Q3 2019

GAAP net revenues staged a decline from $95.5 million in the third quarter of 2018 to $66.7 million in the third quarter of 2019.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has earlier today reported its key financial and operating metrics for the third quarter of 2019, with the data revealing a net loss and a drop in revenues.

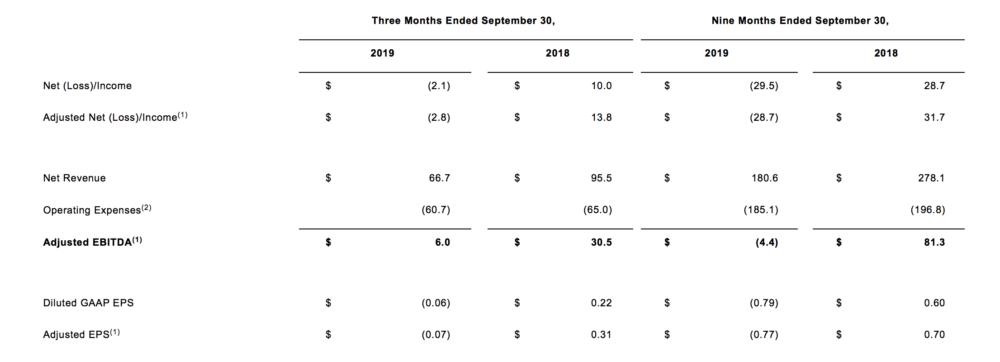

GAAP net loss for the three months to end-September 2019 was $2.1 million, or loss of $0.06 per share. This compares to net income of $10 million registered in the equivalent period a year earlier.

GAAP net revenues staged a decline from $95.5 million in the third quarter of 2018 to $66.7 million in the third quarter of 2019.

During the third quarter of 2019, GAIN reported adjusted net loss of $2.8 million, or loss of $0.07 per share. Adjusted EBITDA for the period was $6 million.

In terms of operating metrics, GAIN said that retail trailing 3-month direct active accounts increased for a third consecutive quarter. Marketing investment supported new direct account growth of 97% year-over-year and 32% quarter-over-quarter.

Pockets of volatility in US equity markets drove growth in futures average daily contracts 24% over the prior year.

Glenn Stevens, CEO of GAIN Capital, sought to strike an upbeat note about the results.

“The third quarter continued to show positive signs of client engagement as our Retail trailing 3-month direct active accounts increased for a third consecutive quarter, providing evidence that our marketing efforts are helping to grow active accounts, even amid the unusually low volatility environment,” stated Mr Stevens.

“In addition, we delivered direct new account growth, which was up 97% over Q3 2018 and 32% sequentially, further evidencing the effectiveness of our marketing. In Futures, average daily contracts increased 24% as we saw pockets of volatility in the US equity markets. With growing interest and activity from our new customers, we feel well positioned to benefit from a return to more normalized market conditions,” Mr Stevens concluded.