GAIN Capital reports net loss of $60.8m for 2019

The company blamed the losses on multi-year low volatility.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) certainly made a splash today by announcing its acquisition by INTL FCStone. GAIN also reported its results for the final quarter and full year to the end of December 31, 2019.

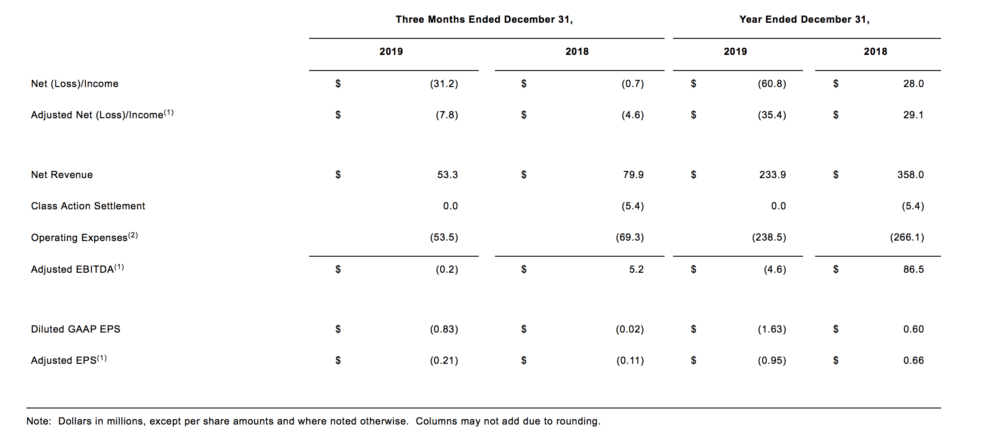

The company posted net loss of $60.8 million for full year 2019, with the net loss for the final quarter of 2019 being $31.2 million. This compares with net income of $28 million for full year 2018 and a net loss of $0.7 million for the final quarter of 2018.

Net revenues were sharply down from 2018 levels. GAIN reported net revenues of $233.9 million for full year 2019, down from $358 million a year earlier. Net revenues for the fourth quarter of 2019 amounted to $53.3 million, down from $79.9 million.

GAIN reported Adjusted EBITDA of $(4.6) million, compared to $86.5 million in 2018.

The company attributed the losses to poor volatility. Glenn Stevens, CEO of GAIN Capital, explained:

“2019 will be marked as a year of multi-decade low volatility, or in some cases, such as Eurodollar, all-time lows, which understandably had an adverse impact on GAIN’s financial performance. Despite that, our focus on organic growth saw good year on year improvement in key underlying client metrics, with new direct opened accounts improving 67%, Retail client equity 12% higher and 3-month direct actives increasing for a fourth consecutive quarter to finish 13% above Q418. As such, we remain well positioned to capitalize on increased volatility upon the return of more normal market conditions.”

Also today, GAIN said it would be acquired by INTL FCStone in an all-cash transaction. GAIN’s stockholders will receive $6.00 per share, representing approximately $236 million in equity value.

The transaction represents a 70% premium to the closing share price of GAIN’s shares on February 26, 2020 and a 60% premium to the volume-weighted average price of GAIN’s stock in the 30 trading days ending on February 26, 2020.