GAIN Capital’s Board continues to recommend INTL FCStone deal

GAIN’s Board notes the fact that the merger consideration of $6.00 per share is all-cash, and therefore unaffected by the considerable uncertainty in financial markets related to the spread of COVID-19.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has published a SEC filing providing an update on its recent financial performance and on its stance regarding the deal with INTL FCStone Inc. (NASDAQ:INTL).

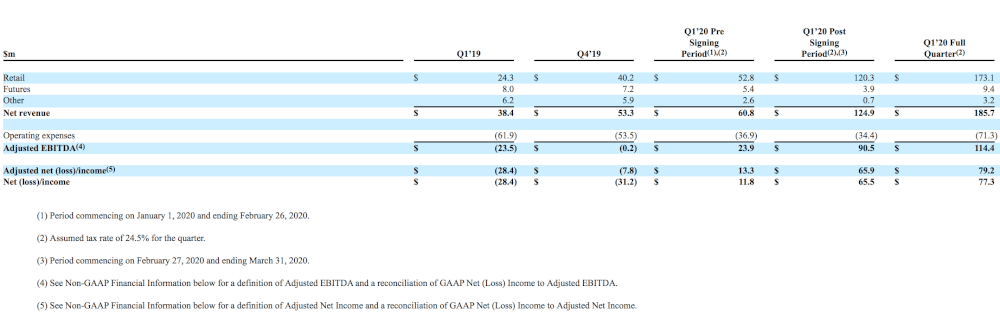

GAIN explains that the volatility during the period commencing on February 27, 2020 (the first trading day following the signing of the merger agreement) and ending on March 31, 2020, the last day of the first quarter of 2020, increased very significantly as compared to both the period commencing on January 1, 2020 and ending on the date the merger agreement was signed, February 26, 2020 and the first quarter of 2019.

These extraordinary levels of volatility in the post-signing Q1 period led to a significant increase in retail customer trading volume during the post-signing Q1 period. Specifically, average daily trading volume (“ADV”) during the post-signing Q1 period was $17.8 billion, a 123% increase from $8.0 billion, the ADV during the pre-signing Q1 period, and a 131% increase from $7.7 billion, the ADV during the first quarter of 2019.

Similarly, the heightened volatility resulted in a significant increase in retail revenue per million (“RPM”) during the post-signing Q1 period, which increased to an RPM of approximately $281 during the post-signing Q1 period, an increase of 71% and 462% from an RPM of $164 and $50 in the pre-signing Q1 period and the first quarter of 2019, respectively.

As a result of the foregoing, GAIN’s results of operations increased sharply during the post-signing Q1 period, with approximately 67%, 85% and 83% of the aggregate revenue, net income and adjusted net income, respectively, for the first quarter of 2020 generated during the post-signing Q1 period.

The GAIN board continues to recommend that the merger agreement be adopted by the stockholders of GAIN, by a vote of seven to one. However, the subsequent developments that have occurred following the signing of the merger agreement, resulted in the GAIN board continuing to review its recommendation, including both the positive and negative factors which the GAIN board considered in arriving at its initial positive recommendation.

Furthermore, the GAIN board has, with the assistance of its financial and legal advisors, reviewed, and continues to review, its rights under the merger agreement, including without limitation the GAIN board’s right, subject to compliance with certain restrictions in the merger agreement, to make an adverse recommendation change in connection with a “company intervening event”.

The GAIN board says it will continue to review its rights under the merger agreement, including its rights relating to the determination of the existence of a “company intervening event” and changing its recommendation to the GAIN stockholders up to the time of the special meeting.

The GAIN board considered a number of factors in determining to continue to recommend that the stockholders adopt the merger agreement including:

- the fact that the merger consideration of $6.00 per share is all-cash, and therefore unaffected by the considerable uncertainty in financial markets related to the spread of COVID-19,

- the fact that if the GAIN board were to make an adverse recommendation change involving or relating to a company intervening event, INTL would be entitled to terminate the merger agreement and, in connection with such termination, GAIN would be required pay INTL a termination fee in the amount of $9 million,

- the fact that the significant improvement in GAIN’s financial performance in the first fiscal quarter of 2020 (as compared to the same fiscal quarter in 2019) was primarily due to the extraordinary developments resulting from the COVID-19 global pandemic, including significant increases in ADV and RPM, and there can be no assurance that such improvements in financial performance would continue or be maintained,

- the challenges presented by the prevailing industry, economic and market conditions and trends in the markets in which GAIN competes were likely to remain present following the anticipated resolution of the COVID-19 global pandemic,

- the fact that GAIN’s exploration of strategic alternatives involved a lengthy and thorough auction process involving 108 potential bidders, in addition to INTL, which included both strategic and financial potential acquirers, eight of which, in addition to INTL, entered into mutual confidentiality agreements with GAIN and received information related to GAIN, but none of which resulted in a credible, financed alternative transaction other than the merger, and as a result, if the merger agreement were to be terminated, there was a considerable risk that no credible, financeable alternative transaction would be available, and

- the fact that stockholders of GAIN who comply with the requirements of the Delaware General Corporation Law will have appraisal rights in respect of their shares and will be able to seek such appraisal if they believe that $6.00 per share in cash does not represent a fair value for their shares.