GAIN Capital’s GetGo mobile app offers enhanced “Your Performance” tab

Traders can look at individual trades, with their results broken down by Hot and Not-Hot signals as well as by market.

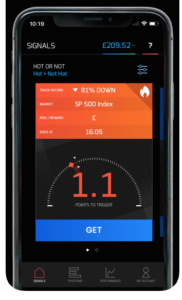

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) continues to bolster its innovative mobile trading application GetGo, with the latest version of the app for iOS devices being rolled out today.

The focus of the enhancements in the new version of the solution is the Your Performance tab, which now has three components – Overview, Hot vs. Not-Hot, and Market. Traders can look at individual trades, with their results broken down by Hot and Not-Hot signals as well as by market.

- Overview

This sections shows traders their net P&L, number of winning and losing trades as well as their best and worst trades. Traders can still see the list of all signals traded and their outcomes in chronological order – expanding on each signal will allow them to view more detailed information.

- Hot versus Not-Hot

This section offers traders information on how many of your traded Hot and Not-Hot signals were winners and how many were losers in the selected time range. They can also see their P&L for Hot signals vs. Not-Hot signals.

This section offers traders information on how many of your traded Hot and Not-Hot signals were winners and how many were losers in the selected time range. They can also see their P&L for Hot signals vs. Not-Hot signals.

- Market

Traders may swipe to the Market sub-tab if they want to view all their trades broken down by market in descending order and, for each market, the number of trades placed, the win/loss ratio and net P&L.

In addition, the latest version of the solution offers a new way to select the time period traders want to see results for. To make use of the feature, traders can check the top of the Your Performance page and use the quick links, e.g. Today, Yesterday, Last Month, Last 7 days, Last 30 days, etc.

Let’s note that the Your Performance tab was updated earlier this month. Users of the solution can check their net P&L, how many trades they have placed, how many ended in a win and how many in a loss, as well as their biggest winner and biggest loser – all in one tab. These changes should allow traders to better analyze what is working for them and what is not.

Furthermore, GetGo’s Level – the suggested Profit Target for each signal, has been updated and optimized to reflect current market conditions – the developers aim to do this in most releases and as a result, users might notice a change in the default position of the slider. The aim of GetGo’s Level, which was rolled out in April this year, is to help traders take profits at the right time and to improve their outcomes. Traders can change it or turn it off and let the trade close at the end of the signal’s time window.

Less than a fortnight ago, the GetGo app was released on Android devices. The solution features a full suite of ‘How to’ tools designed to get traders started quickly and easily. It offers traders to get real-time trade signals as notifications, as well as to make use of flexible trade sizes. The range of markets includes FTSE, DOW JONES, DAX, GOLD, OIL, as well as a number of currency pairs like EUR/USD and USD/JPY.