GAIN Capital’s GetGo mobile app ready to go international

GetGo now has the ability to accept USD, AUD and EUR accounts.

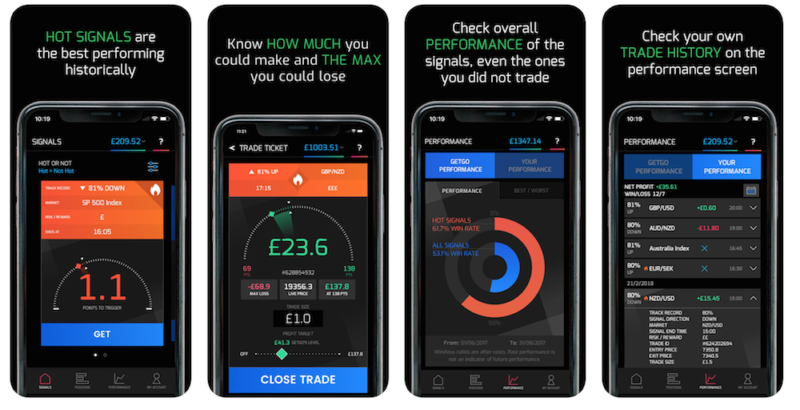

GetGo, the innovative mobile trading application offered by online trading major Gain Capital Holdings Inc (NYSE:GCAP), continues to enjoy enhancements. The company has prepared the application to go international, as it now has the ability to accept USD, AUD and EUR accounts.

Let’s recall that the solution was initially rolled out by GAIN in the United Kingdom, with the company planning to launch the solution in other markets throughout 2018. Apparently, the enlarged account acceptance is a part of the move towards this expansion. The app is currently available to users of iOS devices, but the launch on Android is coming soon. In fact, during the presentation of its results for the first quarter of 2018, GAIN said the release of GetGo on Android devices should happen in May 2018.

The list of enhancements in the latest version (1.0.9) of the solution released early this week includes acceleration of the connections to live prices. Also, the app should be a little better at remembering the username and password, if users have ticked the ‘Remember me’ box on the sign in page. (The developers have had user feedback that it can be a little “temperamental”).

Furthermore, the app may now add images with the notifications, so traders should expect to see a few eye-grabbing images with the notifications in the not too distant future.

GetGo is updated regularly. In April this year, a new feature that suggests the Profit Target level, based on past performance, was added to the app. GetGo’s Level appears on the Profit Target slider. The aim of GetGo’s Level is to help traders take profits at the right time and to improve their outcomes. Traders can change it or turn it off and let the trade close at the end of the signal’s time window.

And, about a month before that update, the app saw some adjustments to the risk warnings. The application has a popup which tells clients not to place too much of their funds on any one trade. Previously, this message was displayed when users risk over 20% but, starting with version 1.0.7 of the app, this level has been moved down to 10%. Placing trades with a smaller percentage of one’s account balance means less erratic returns, the developers note.